12 Best Financial Tips For Single Parents

Are you looking for the best financial tips for single parents?

As a single parent, managing your finances can be extremely difficult when you have a million other things going on.

You might be so tired you forget to put your pants on, let alone deal with your financials.

I totally understand, but it’s definitely important to handle your finances to limit the number of financial struggles you and your kids face.

Here are the best financial tips for single parents to manage their money easily…

Update Your Will

I don’t mean to start off with such a grim subject, but it’s crucial, especially for a single parent.

You want to ensure your children are financially covered if you get sick or pass away.

Of course, hopefully, this doesn’t happen, but we have no control over certain things, and you just want to be prepared.

While you don’t want to think about worst-case scenarios, you really need to.

Sit down and decide who you want to be your child’s guardian and who will manage the money until the child is older.

Update your will regularly with any changes you need to make and provide it to a trusted family member or friend.

It’s not a fun topic at all, but it’s one of the most important financial tips for single parents!

Check Your Beneficiaries

Do you have life insurance, retirement, or investment accounts? If so, verify and update your designated beneficiaries.

That way, if something happens to you, the money goes where you intend it to go.

It’s especially important to check with your estate attorney (whom you used to update your will) about how to designate your children as beneficiaries.

Why?

You’ll likely want to set up some trust for them rather than giving them all the money when they are too immature to handle it.

Setup An Emergency Savings Account

One of the best financial tips for single parents is to have an emergency savings account.

An emergency savings account is self-explanatory; it’s a savings account that is used for those unexpected events that occur in life.

For example, your car can break down, you can lose your job, your kid can get sick, etc…

Hopefully, none of this happens, but you have no control of life, and unfortunately, sucky things happen sometimes, and you should be financially prepared for these emergencies.

With an emergency account, you will have peace of mind knowing you have the funds to cover or mostly cover a financial emergency.

Having at least three months’ worth of expenses saved in an emergency account is highly recommended, but 6-months’ worth is much better.

I know… this is a lot of money, but you don’t have to fund the account with all of this money on day one; build it up over time; it’s better to be safe than sorry.

I highly recommend using a high-yield savings account with a trustworthy bank so you can earn interest on your money, and you can do this with CIT Bank.

CIT Bank is a highly-rated and trusted bank that offers a high-interest rate on their savings account compared to many other banks!

This is awesome because you can earn money on your savings, so I highly recommend checking out CIT Bank.

Get Your Insurance In Order

Insurance is one thing nobody loves but is important because, without it, you’re pretty much screwed.

As a single parent, it’s super important to have proper health, life, and disability insurance to ensure you and your kids are covered in the case of an accident.

Let’s dig a little further…

Health Insurance

If you get family health insurance through work, make sure you have your kids included in the plan, so they are covered under your health insurance.

If you cannot get insurance through your job, then look around for plans for single parents.

There are many options to choose from, so just shop around and choose the plan that is best for you.

Life Insurance

When you were child-free, you may not have thought much about life insurance.

But…

With a little one to care for, you want life insurance if you can get it. A good term policy is a great option, especially when you are younger and healthy.

Life insurance will provide that safety net for your children if any unfortunate event occurs to you.

Disability Insurance

You may also want to look into disability insurance, especially if it is offered for free through your employer.

What is it? Insurance will replace a portion (not all) of your income if you are out of commission due to a disabling illness or accident.

This is super important since you are most likely the only source of income for your family, so you want to ensure that you have at least some income coming in before you go underwater.

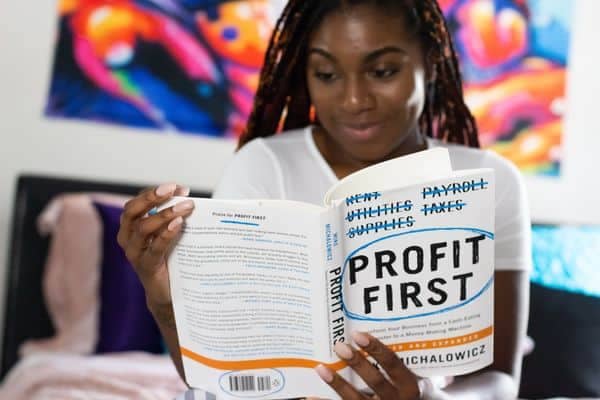

Start A Budget

One of the best financial tips for single parents is to set a budget and stick to it!

A budget is a super important part of a financially healthy lifestyle, and it’s especially important for a single parent!

With one income and caring for yourself plus your children, you most likely find that your money dwindles each month.

When you set a budget, you will be better able to control your money and save more by cutting costs.

Start by writing down all your expenses and dive deep into everything you spend money on.

Figure out what things you can cut out to save money, such as subscriptions that take money out of your account each month!

Also, for the expenses that you need, think about ways you can cut costs.

For example, the three biggest expenses for most people are housing, transportation, and food.

If your mortgage or rent is costly, consider moving into a smaller house or apartment to save money.

Same for your car, if you have a vehicle that you are still paying off or is a gas guzzler, consider opting for a cheaper, more reliable car that won’t cost you as much.

For food, consider tips such as buying less meat, choosing a more affordable grocery store, using a cashback app such as Fetch Rewards, etc…

After you figure out all of your expenses, write down all your forms of income; most likely, you only have one, but write down how much is left after all your expenses.

The goal is to minimize your expenses as much as possible and boost your savings so you can fund your emergency account or your children’s college savings account, which we will discuss next.

Budgets don’t have to be scary; many apps/services can help take the workload off of you.

I recommend checking out Rocket Money, an app that will help you set up a budget and lets you cancel subscriptions right from the app!

Rocket Money also lets you track your spending, automate your savings, track your net worth, and more!

I highly recommend checking out Rocket Money and using it to help you set up a budget and save money!

Start a college savings account

As mentioned before, setting up a college savings account for your children is super important due to the rising tuition costs.

Starting a fund now, no matter the age of your kids, will give you peace of mind when that time comes to pay college tuition, and it will also give your kids a jump start in life.

Give your kids a head start by opening a 529 account. Even if you don’t have room in your budget yet to put much in there, that’s fine.

You can ask grandparents and other relatives or friends to gift money to the account rather than fill your house with noisy toys.

Many plans offer ways for people to gift to the account with a simple link or a form that can be printed out and mailed in.

Starting a college savings account and utilizing a 529 account is one of the best financial tips for single parents to save money in the long run.

The great thing about a 529 account is that it’s an investment account, so your money will grow over time, meaning that more money than what you put in will be available for your children’s college tuition.

I highly recommend considering this!

Increase Your Income

Sometimes, you save as much money as you can, just shy of living in a box, but it’s not enough.

So…

You need to find ways to make more money to cover your expenses.

Nobody wants to work more than they already are, but if times are tough, you need to put in the necessary work to get out of the gutter.

The best way is to ask for a raise at your current job; if you are a good worker and perform your duties without any issues, you should get the raise you deserve.

Taking this further, you can ask for a promotion; yes, this comes with more responsibilities but higher pay.

The other option will be to get a new job; I know starting over sucks, but if you are stagnant at your current company, moving on is the best way to make more money and advance in your career.

Last but not least, if you like your current job but still need extra cash, consider joining the gig economy.

You can pick up a side hustle to make some extra money in your free time!

Think about side hustles like delivering for Doordash, Instacart, selling candles, etc…

You can choose from many side hustles to make money, so just look around, and you’ll find the right one for you.

Ask For Assistance

There is no shame in asking for help when you are financially struggling, so just seek help if you really need it!

There are many government programs that can help you in times of need.

You can get tax breaks, food assistance, insurance help, housing subsidies, etc…

There is help out there; you just need to do your research and apply to programs you qualify for.

These programs will help you get you back on your feet, so don’t be embarrassed or ashamed to get well-needed help; that’s what these programs are here for!

Set Financial Goals

Last but not least, one of the best financial tips for single parents is to set financial goals.

Your financial goals can be anything from funding an emergency account, saving for your kids’ college, investing, retirement, etc…

You need to set goals to avoid getting stuck and have a plan on what to do next in your financial journey, so it’s best to set achievable goals to attain.

Start with simple goals, such as putting $100 monthly into an emergency fund, then go from here.

After you achieve a goal, set another one and go from there. You will be surprised at how much you can achieve by simply setting goals, so I highly recommend doing this!

Conclusion

These are the best financial tips for single parents!

With these tips, you can improve your finances to give yourself and your children a better life.

Life as a single parent must be rough, but there are things you can do to ease the weight off your shoulders.

If you like this post, then I recommend checking out my posts on How To Manage Finances In A Marriage and Financial Literacy For Kids: 10 Best Methods.

What tip is the most helpful to you? What other financial tips for single parents do you have to add? Let me know in the comments below!