Budgeting After College (Finance Tips)

Disclosure: This post may contain affiliate links and if you choose to sign up or purchase a product/service through our links we may receive a commission at no cost to you. Please read our full privacy policy for more information.

Budgeting after college is necessary as you begin your life as an adult, and this article will help you achieve this!

As a new graduate, you’ve got the world ahead of you. Those long hours of churning through books, taking exams, and wanting to break out of the education system are behind you.

You’re ready to enter “the real world” and start the next chapter of your life.

It can be an overwhelming time as you try to balance so many new experiences and priorities, and one significant change you will experience is your finances.

From general day-to-day money management to investing for retirement and everything in between, it’s an important focal point that every person needs to grasp.

There are many topics in personal finance that you should learn after college, but we’ll focus on budgeting after college.

You can manage your money better and become financially stable with a budget.

Let’s get straight into it…

Build Your Knowledge About Personal Finances & Money Management

Before you start budgeting after college, you need to learn about money and how to manage it.

Not only this… you have to get into the mindset of improving your financial life because, without a will, there is no way.

Financial literacy is a general pitfall of the current education system and society. One of the biggest wins you can have is to counteract those potential shortcomings immediately.

You need to build a foundation of knowledge about personal finance and money management principles.

Start with some easy-to-understand lessons and insights on money’s role in your life.

You’ll quickly learn that you’re in control, and your eyes will be opened to the simple steps you can take to set yourself up for success.

I recommend books like The Simple Path To Wealth, Your Money Or Your Life, I Will Teach You To Be Rich, The Millionaire Next Door, and Millionaire Teacher.

These offer wide-ranging, all-encompassing financial management teachings and strategies for someone to grasp at an early age.

There are many other personal finance books to read and learn from; I also recommend checking out personal finance blogs (such as Savebly) to learn more about personal finance as well!

The natural side effect of diving headfirst into personal finance books like the five above will be a desire for continued learning. They will put you down the path of setting up your financial framework.

Before you start budgeting after college, it’s super important to get into the personal finance mindset and learn about managing your money.

Avoid Lifestyle Inflation As A College Graduate

Chances are you lived a moderate life during college or university.

Maybe you bought a few new pieces of clothing each summer, but ideally, most of the money you earned at your summer jobs went to support your tuition.

Hopefully, you had some fun with that money, too, you’re only young once, but the point is that you don’t have much money in college, so there isn’t a lot to spend.

Now…

You’re starting your career and earning a comfortable salary. This new bi-weekly payment will likely be the most money you’ve ever received in your life. And it will keep coming every two weeks. You may get a bonus after your first year and progress your salary with deserved raises each year.

So, why not buy those things that you always wanted? That new car, clothing, expensive dinners, vacations, etc…

Well… you should enjoy your life and money, but you must be conscious of what you are spending and what the future entails.

Have fun but don’t let lifestyle creep set in as your income grows!

It will be so tempting to splurge. We’ve been hardwired this way from decades of TV commercials, Instagram celebrities, and psychological warfare from marketers. Fear of missing out, or FOMO, will tug at your wallet or purse.

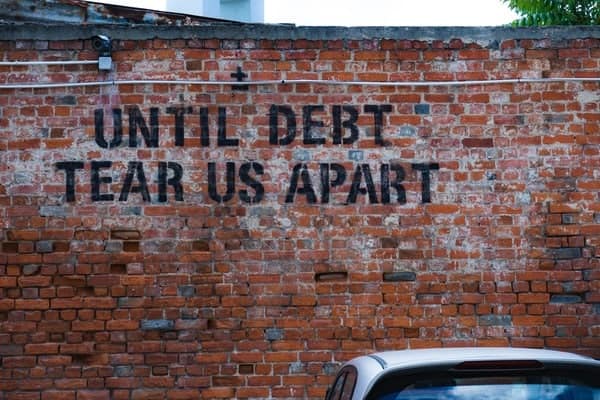

Don’t try to keep up with the Joneses. Let the Joneses overspend or get into debt as your wealth builds and builds.

The big three expenses (housing, transportation, and food) will be the most likely culprits of lifestyle inflation.

If you want to start budgeting after college, then it’s crucial to avoid too much lifestyle inflation, and you need to learn about the three most significant expenses, so let’s dig deeper into each one…

Saving Money On Housing

Avoiding lifestyle inflation on your housing is a major opportunity to expedite your financial success at an early age.

Housing costs will be one of your most significant expenses as a young adult, so it’s always best to find ways to cut costs, and these are some of the best ways to do so.

Stay At Home

According to the U.S. Census Bureau, a third of all 18 to 34-year-old young adults live at home with their parents. Pew Research states that it includes 15% of 25 to 35-year-old millennials.

I know, after college, you should be living on your own and becoming independent but building wealth and mastering your money isn’t about being cool.

If your financial situation could be better, then living at home with your parents can save you tens of thousands of dollars in the first two years after university.

You can save $ 10,000’s by living at home with your parents for a few years until you become more financially stable, so it’s definitely worth considering!

It might not be the freedom you desired, and your mom asking you to make your bed might be a nuisance. But your future bank accounts and financial standing will thank you.

Staying at home for an extra year or two after graduation could change your entire financial journey.

Get Roommates/Househack

If moving out or living under your own roof is the strategy best suited for you, there are some surefire tactics to manage that expense inflation as well.

If you lived on campus during university or lived with friends offsite, why not continue the trend of having roommates?

This chart from Trulia highlights that we’re looking at 30% to 40% savings by sharing a 2-bedroom instead of your own 1-bedroom. Similar to living at home, this will expedite your wealth building.

Another option if you’re in the situation of being able to purchase a home is an opportunity to house hack.

What’s house hacking? It’s a method to make money from your home by renting out a part of your house.

For example, a standard method is renting out a floor in your home or basement to make some extra income.

In essence, you can live for free (or much less than average) by having roommates pay you rent (that covers some or most of the mortgage). Or purchase a duplex; you live in one unit and rent out the other.

It allows you to use money from other people to pay down the mortgage and eventually reap the appreciation value.

Controlling Transportation Costs

Transportation is the next area of the big three that can often become a victim of lifestyle inflation.

You’re a working professional now earning some good money. You deserve a nice ride, right?

You might want to finance a brand-new car. However, as soon as those wheels pull off the lot, that asset depreciates rapidly.

New cars generally lose 20 to 30% of their value in the first year!

The interest rate on your car note also means you are paying money to someone else.

Having debt is not great, so you should avoid taking out a car loan right out of college because this will just put you behind.

You’re looking to build wealth and financial freedom. You can take a different path here with your transportation should you choose.

Buying Used Cars With Cash

Mr. Money Mustache (a name I hope you became familiar with from the books and resources) shared his insights on buying a used car. And here is another post from Mr. Money Mustache on used cars.

If you need more convincing, here is an article from Money Help Center outlining the benefits of buying a used car.

Dependable, well-maintained, and cost-effective.

If you use those three criteria in your search for the perfect vehicle, you’re setting yourself up for success. The money momentum on your financial journey continues to roll.

Accommodation Selection

Another option that would ladder into our housing section above would be selectively living close enough to your place of work so that you can walk or bike.

Choosing a place close to work and everything else you need is best. You can then walk or bike to places that can save you $ 1,000, plus the benefits on your health and general well-being.

It might not be an option for you based on your living situation and career, but it’s something to consider.

Saving Money On Food

The final piece of the big three expenses is, of course, food. Sustenance. Tasty, delicious nutrition. Unfortunately, with our increased income can also come an increase in the dollars being spent on food.

You don’t need to live a life of squalor on ramen noodles and saltines. You’re an adult, and adults like to eat out, have a drink, and enjoy the company of loved ones, friends, and co-workers.

Focus on sticking within your budget and be mindful of your spending habits in a few key categories.

Groceries

A typical grocery shopping mistake is strolling into the store with no list, plan, or idea of what you need. It’s like whatever catches your eye dictates what goes in your cart.

This is a costly mistake and should be avoided at all costs. You need to create a shopping list with the items you need to purchase and stick to it.

Yes, you can get some things you want here and there to keep your sanity but be conscious of your spending.

Simple, easy-to-implement tactics to save over a thousand dollars each year.

The art of saving money on groceries essentially boils down to a few key points.

- Find the cost-effective store options near you

- Meal plan

- Make a list

- Stick to that list

- Leverage coupons or special offers when they make sense

- Bulk cook

- Rinse and repeat

It can be pretty simple once you build a grocery shopping and cooking system that fits your lifestyle. With effective spending and planning, you’ll avoid that lifestyle inflation and live within your means.

I also recommend checking out Ibotta, which is an excellent cashback app that will help you save $ 100’s to $ 1,000’s on grocery shopping each year!

Ibotta is free and super simple to use, so there’s no reason why you shouldn’t be using it.

Lunch

Saving money on lunch is really simple; pack lunch to work.

Yes, that’s it! This one simple thing can save you $ 100’s to $ 1,000’s each year!

It’s not fun, but buying food every day for lunch will dig a deep hole in your wallet, and this is not fun, either.

A simple tip to keep your sanity is to buy lunch one day a week to satisfy that craving and enjoy lunch with co-workers.

Start A Simple Budget

Now that you are learning more about personal finance and have a great foundation on what to look out for, it’s time to start a budget.

Budgets don’t have to be scary, and it definitely doesn’t have to be perfect!

The most important thing is starting a budget based on your spending habits; you can always adjust it later.

Many apps like Mint and You Need A Budget will automate this for you, but I recommend manually starting a budget since these apps have shortcomings.

You can use a pen and paper or use Google Sheets or Microsoft Excel on your computer to set up your budget.

Firstly, list down all your monthly expenses (including debt) and all the forms of income you have.

At this point, hopefully, your income exceeds your expenses! The next step is to separate your expenses into needs and wants.

Be very honest with this process! Write down all the things you need in one list and all the things you purchase that are classified as wants in another list.

First, start with the wants list. Is there anything here that you can live without (at least for a while)? Anything that doesn’t provide you with much joy? Find things you can cut out to save money without drastically impacting your happiness.

There is likely a lot of money to be saved by cutting out some things, so carefully review your wants and get rid of things.

Now, moving on to your needs, you can’t just cut out things you need but are there any ways you can save money? Can you use less? Are there services to cut costs? Etc…

For your needs, find ways to cut costs in any way you can. For example, we went over the three significant expenses and ways to cut costs on these.

Constantly Adjust Your Budget

As we discussed earlier, a budget needs constant adjustment, especially as a college graduate.

A budget is not a “set it and forget it” kind of thing; you need to review it periodically and then make adjustments.

Life after college is hectic and constantly changing. You might be moving to a new city, purchasing a house, getting married, starting a family, etc…

Many things happen after college, and all these big life changes require you to adjust your budget to suit your lifestyle best.

For example, if you have children, then you need to budget for more food, pampers, clothes, etc…

The best option to do is to review your budget and financial situation before making a big life change to see if you are financially ready.

We spoke about not giving in to lifestyle inflation, but there are times when you will have to increase your spending to live comfortably, so it’s best to review your budget and adjust accordingly.

Simply put, budgeting after college doesn’t end. You have to continue your personal finance journey and keep learning and growing.

Conclusion

Budgeting after college doesn’t have to be complicated or scary; it’s essential as you go into your adult years.

If you’re actively looking to master your finances and grow your career, you’re undoubtedly setting yourself up to take advantage of all that comes your way.

New and exciting opportunities will present themself to you as you navigate the next 5-10 years of your life.

Be flexible and adaptable. You’re young and have the world ahead of you. Have fun but remember to stay on top of your budget and be financially conscious of your decisions.

If you like this post, then I recommend checking out my posts on How To Budget Money On Low Income (11 Best Ways) and Smart Spending Habits To Save More Money.

Have you started budgeting after college? What are your tips for budgeting? Let me know in the comments below!