Downsides To Personal Finance And How To Overcome Them

I have been in the personal finance space for a while now and it has been going great but I feel that there are some downsides to personal finance that you need to know!

Listen, this post is not to talk bad about personal finance or personal finance bloggers. The point of this post is to show you that there are downsides to personal finance but I will show you how you can overcome these struggles.

The personal finance community is full of information that can help you improve your financial life.

But…

There are just some things that you are probably struggling with, heck I struggle with some of these myself, so I think it’s something worth talking about.

So, Let’s get straight into these downsides of personal finance and how to correct them!

Affecting Relationships

This is such a huge problem for some people who are embracing personal finance!

In a lot of relationships, there is most likely the spender and the saver (you know which one you are) and there is most likely some clashing that goes on.

If your significant other (or yourself) has this “spending” mentality and the other is in a personal finance mentality then there will definitely be differences.

Trust me I hear situations like this all the time!

You might be in a similar situation and I know it is hard so I want to give you some tips to get through these difficulties because this is definitely one of the biggest downsides to personal finance.

Setup A Fun Account

On your personal finance journey, you shouldn’t deprive your significant other and yourself of having some fun in the present.

So…

You should consider setting up a fun account and set aside some money every week or so to put in that account and use it just for going out with your significant other.

This is such a simple way to balance your spending and still have fun with your partner!

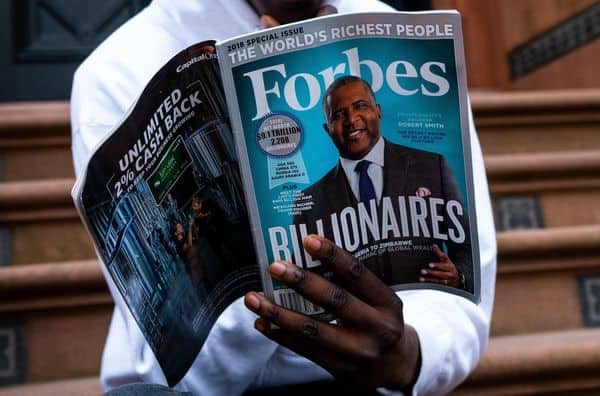

For my fun account, I use a joint Capital One 360 Checking account and we both set up an automatic deposit in this checking account from our primary checking account to use just for going out.

Capital One 360 has been working great for me and there are no fees at all! (other than overdraft fees which you can set to auto-decline)

Also, you also earn interest on your money! It’s a small amount though, at the time of writing this it is 0.20% but it’s free money.

If you are interested in signing up for a Capital One 360 checking account you can sign up here.

A fun account is a great way to balance out the relationship with your significant other and you will get to have fun without worrying about the money because you already budgeted for it!

Set A Finance Date Night

What the heck is a finance date night?

A finance date night is where you and your partner set a date night once a week or once every two weeks and you spend a portion of the date talking about your financial situation.

Before you ask, yes you will use the fun account for this!

Go to dinner, the park, for drinks, etc… and spend a portion of the date talking about your finances and what is working and what is not.

Be open with your partner and tell them to be open with you too, work with each other’s differences, and on every date overview your financial situation and come to an agreement on any changes that need to be made.

This shouldn’t take the whole date night to do, so after this just have fun!

Also, remember to use your fun account for these dates.

Communicate

I know the previous point touches on communication but you should constantly communicate with your partner not just once a week.

Communication is a huge part of a relationship and not just for financial reasons, I know it’s hard at times but it helps to build trust and understanding in a relationship.

This is the key to having a healthy relationship. In regards to money, communicate with your partner about what you think you both can do better for your financial plan.

For example, if your partner is spending too much money on clothes then let them know that they are spending too much money.

Show them how much is being spent on clothes and let them know that they can spend much less by not buying so much or shopping at different stores.

Also, show them what can be done with the money that can be saved by spending less on clothes, like paying off debt or investing.

By having these conversations you will be able to improve your financial plan and you will improve your relationship overall!

Saving Money Is Everything

One of the biggest downsides of personal finance is the big push on frugality and saving as much money as you can.

Wait, before you bite my head off let me explain.

I am big on saving money and I do believe you should save as much as you can but I have seen people practice extreme frugality because they think this is the way to financial freedom.

This is not the right way!

You should be saving money and budgeting but you should spend the majority of your time focusing on increasing your income!

For example, I have seen people on Facebook communities posting scenarios like this:

“I make $40K a year and I am renting an apartment with 3 other people, I barely go out and I save as much as I can, I spend hours every day budgeting and looking for ways to cut costs. I have about $16K in debt and I am really struggling to save more money. Where else to cut costs? Please help!”

And then in the comments section, there are some people who say there are always ways to cut costs, just look harder.

I mean come on!

In all fairness, there are some people who comment and say that this person needs to make more money and they are totally right!

Of course, there are those people who make over $100k and are struggling, these people need to focus primarily on saving but most people don’t make this kind of money.

In fact, according to Seeking Alpha, the average American household as of January 2018 has a median salary of $59,055.

Keep in mind this is household, not individual!

Now with this median salary along with inflation and increasing consumer goods prices how can one focus primarily on saving more money?

The fact is people might be able to cut costs in some way but where does it cross the line of impacting their quality of life?

I don’t know the answer to this, it really depends on the individual but let’s go over some tips to overcome this hurdle.

Track Your Spending

A great way to know if you need to save more money or if you need to make more money is to track your spending!

By tracking your spending you will know if you should focus more on saving or more on increasing your income.

Don’t get too tied up using budgeting sheets and all that for now, just get a tracking app like Mint (which I use and love).

Mint tracks and categorizes your spending for you automatically! All you have to do is link your accounts and that’s it. I notice that some purchases are incorrectly categorized but it is so easy to fix it.

So, the first step is to track your spending and spend some time reviewing where you spend your money. This way you will know if you need to save more money or if you need to make more money.

The best thing to do is both, but don’t let saving money affect your quality of life.

Make Money In Your Free Time

There are many ways to make some money in your free time.

I’m not telling you to spend all your waking hours working but you can spend a few hours here and there on your free time doing side hustles for some extra income!

If you don’t want to leave the house, then check out Swagbucks or Amazon’s Mechanical Turk to make some extra money.

Own a car? Then check out my post on 24 ways you can make money with your car!

Have a skill that you can offer to people? Then take some freelance gigs on TaskRabbit or UpWork.

There are simple ways to make some extra money on the side. If you want it bad enough then you will make it happen!

Advance In Career

A very simple but not so easy way to increase your income is by getting a new job.

According to Monster.com, you can generally see a $5,000 – $10,000 increase in income by getting a new job!

For some people, this is a life-changing amount.

So if you are looking for more income consider getting a new job.

If you love your current job then ask your boss for an increase. Now I know this can be a nervous task and you shouldn’t just wing it.

Gather all the information on why you deserve a higher salary, things such as performance reports, tasks completed, etc…

A great way to increase your income is to either ask for a salary increase or get a new job!

Getting Carried Away

One of the biggest downsides of personal finance is obsessing over everything about personal finance.

I see people who spend all day tracking their spending, budgeting, making some side income, etc…

They are basically obsessed with taking control of their money that they neglect the present which can also lead to point number one (affecting relationships).

The personal finance community is great but becoming addicted or obsessing over it can lower your quality of life without you realizing it.

For example, take a look at this post by U.S News discussing the downsides to personal finance.

So…

What can you do if you feel like you are getting too carried away with your personal finance journey?

Work Smarter

What do I mean about working smarter?

For example, let’s say you spend hours every day tracking your spending and budgeting. Why not use a tracking and budgeting app like Mint which does all the work for you?!

Mint will track all your spending for you and let you know when you go over your budget. You will only need to spend about an hour a week reviewing your Mint account.

People keep busy thinking that they are being productive when in reality they are just being busy.

So, on your personal finance journey work smarter by automating most of your tasks. This will free up your time so you can enjoy the present instead of only waiting to enjoy the future.

This can also apply to other things in life such as jobs, running a business, etc…

Set A Schedule

A great way to avoid getting carried away or to correct it is to set a schedule.

Schedule a set amount of time to go work on your finances and stick to your schedule!

Of course, you can make some adjustments but make sure you are sticking with your schedule so you don’t spend all your waking hours working on your finances.

Taking control of your money is a must but you shouldn’t put your life on hold just for your money.

Work on improving your financial life but also enjoy your life!

The Perception Given

One of the other downsides to personal finance is the perception given to it by those who are outside of the community.

I have heard a lot of people outside the personal finance community say that those inside the community are penny pinchers, boring, cheapskates, lazy, etc…

There are people who just don’t understand what personal finance is about and they jump to the conclusion that you are just being cheap.

When in reality you just choose to spend your money on income-producing assets instead of liabilities.

So what can you do?

Communicate

If you know any people with this kind of perception you should talk to them.

Educate them on what personal finance is about.

Explain the idea of financial freedom and why it is such a great accomplishment.

Let them know that the idea of personal finance is not about being cheap.

Personal finance is not even about money, it is about freedom!

You might even spark their interest in the personal finance community, you never know!

Ignore The Noise

Listen, sometimes you won’t get through to people who think like this so just ignore the noise.

You are on a path that will benefit you greatly so you don’t need anybody talking bad about your journey!

Do what you can to block these people out. Everyone has different views on life so try not to be rude.

For example, don’t say things like “hey sh*thead, you don’t know anything at all! ”

I feel like saying this to some people but you have to bite your tongue and rephrase.

For example, when someone asks me to go out every day and I keep saying no, they then say I am boring and lame.

I just say “I know you go out every night spending more than 100 bucks a night but I rather throw that money in some stocks to grow!”

That’s it, and then I go on with my life.

We all want different things in life so don’t judge someone on how they live their life and you shouldn’t let people judge you.

Don’t surround yourself with people who judge you, block them out!

Conclusion

There are some downsides to personal finance but there are downsides to everything so don’t stop your journey completely, just work to correct these issues.

Implementing personal finance tips in your life is great but be careful to not get carried away, this can lead to neglecting those around you and even yourself!

You shouldn’t deprive your present self just to plan for your future self.

Some people work so hard to free their time in the future when they are miserable in the present.

Don’t let this happen, your time is your most valuable asset so spend every second wisely. Plan for your future but also live for the present, you need to find a balance.

These downsides to personal finance shouldn’t deter you from managing your money, with these tips to overcome these downsides you can get past these obstacles.

Lastly, remember that your personal finance is unique, it’s great to read blogs about other’s journey’s but you have to figure out what works for you and what is your end goal.

Your end goal should be true happiness and you achieve this by finding your purpose.

I spoke about finding your purpose in my post on can money buy happiness, check it out!

Do you agree with these downsides to personal finance? What has been the biggest struggle in your personal finance journey?