Smart Spending Habits To Save More Money

One of the most common sayings in personal finance is “it’s not about how much you make, it’s how much you keep, ” which comes down to having smart spending habits.

Yes, the saying is a bit of a cliche, but that doesn’t mean it’s not true.

There are many people who make a lot of money but struggle to make ends meet.

I mean, how many stories have you heard about where celebrities, athletes, etc… go broke? It’s crazy!

Yes, making money is important, but so is saving and investing.

With that said…

Let’s get into smart spending habits that you should implement right now…

Have Open Communication In Your Relationship

No matter how great your spending habits are, if your partner is not on the same page as you, then kiss all your hard work goodbye.

Whether you’re just dating or in a marriage, managing your finances together is super important.

Communication is critical with those impacted or involved in your personal finance journey.

There is no reason that money doesn’t need to be a taboo subject!

If you aren’t in a relationship, maybe as a teen or young adult, this communication might be with your parents.

Money will play an essential role for the rest of your lives.

Getting on the same page is paramount. A simple, open conversation often alleviates the stress and uneasiness that money can sometimes bring into a relationship.

Here are some high-level tips that could help make those discussions more effective:

- Communicate often and discuss your different viewpoints.

- Do your best to contain your emotions and have factual/logical discussions.

- Find out who is the “saver” and “spender” in the relationship to work out discretionary funds.

- Set a date night each month where you can have a money discussion to review your finances.

Money is one of the leading causes of divorce; when times are tight financially, the pressure becomes even more heightened.

Make communication a top priority in your relationship, and have honest conversations about money so you can develop smart spending habits together and stick to it!

Have A Monthly Financial Review

One of the best things you can do to develop smart spending habits is to review your finances monthly.

Without tracking your finances, it will be tough to develop smart spending habits because you won’t know where your money is going.

Life gets busy, priorities change, and money can be stressful, but it’s crucial to keep on top of your money to improve your financial life.

This monthly review helps ensure your finances remain a consistent priority and top of mind on an ongoing basis.

Personal finance is personal (yes, a cliche, as we mentioned, but true), so what one individual does for a monthly review might not apply or be feasible to you.

However, the practice of keeping a set schedule and performing your own monthly personal finance status check will become a great addition to your money management tool belt.

- Track your spending and budget through a service like Mint to ensure the past month’s spending was what you expected.

- Review all your bank accounts, savings accounts, and investment accounts

- Go line-by-line through your credit card statements

- Forecast any upcoming significant expenses or taxes if that time of year approaches

The list could go on and on.

Simply, see where you are spending money and adjust your spending to stop wasting money.

For example, you might find that you are spending too much money on food, and it will be wiser to cook more and eat out less.

The goal is that a monthly review through a set checklist or routine will support keeping an effective and efficient practice of making finances a priority.

Tracking your finances is the foundation for developing smart spending habits, so start right now!

Create A Budget For Your Spending

Now that you have tracked your finances, it’s time to set a budget to limit how much you can spend on certain things.

Tracking your finances is no good if you don’t do anything with it; you need to use it as a guide to create a budget and start saving money!

With a budget, you will be able to save money by limiting your spending.

You can do this manually on paper or Excel or use an app like Mint or YNAB.

Simply start, it doesn’t have to be perfect, but it’s essential to develop one and get the ball rolling; you can always adjust it over time.

One great tip is to set up a separate bank account for discretionary spending such as going out to eat, going to events, date nights, etc…

You will simply fund this account with a small portion of your income each week and use this account for having fun; in the personal finance community, this is often labeled as a fun account.

A budget will help you become smarter when it comes to spending and make better financial decisions overall.

Utilize the 72-hour rule

A great habit to start when it comes to spending is the 72-hour rule.

The 72-hour rule consists of simply waiting for 72 hours before making a purchase you want but don’t need.

We are only human, and sometimes emotions get the best of us which causes us to make bad purchases from time to time because we get caught up in the moment.

Using the 72-hour rule, you will put these purchases on hold until these emotions pass and then make your decision with a clear and rational mind.

Most of the time, you will find that you don’t want the item anymore, but if you still do, go for it if it fits within your budget.

I also recommend using the 30-day rule for large purchases such as a car, house, etc…

These purchases cost a lot of money, so you really have to think if it’s the right decision or time to make these purchases.

You will make more intelligent decisions about spending your money by giving yourself time to think about your purchases!

Use Rocket Money To Boost your savings

An excellent way to cut down on costs and get your spending under control is to use an app called Rocket Money.

Rocket Money is basically an automated financial assistant that will help you save money easily!

The app works by tracking all of your spending and gives you a clear overview of what you spend your money on.

Many people who use Rocket Money find that they are paying for services they don’t need or want anymore, and Rocket Money allows you to cancel these subscriptions right from their app!

Not only this…

Rocket Money will also work with your internet provider to automatically lower your bill!

It’s an awesome tool, so I highly recommend checking out Rocket Money.

Spend less with cash-back apps

If someone will pay you to buy things you were already buying (no strings attached), will you say no?

Of course not! You will gladly take this offer, so why are you not using cash back apps?

Cash back apps are free services that will give you money back for simply using their platform to buy things you were already buying!

For example, if you go to the grocery store to buy milk and use a cashback app, you might get $1 back; this doesn’t seem like much but remember that this is only for one item, add more items, and you can see how valuable this is.

Here are some of the best cash-back apps to use right now…

Rakuten Savings

One of the most trustworthy and well-known cash back apps that I recommend using is Rakuten.

Rakuten (formerly known as Ebates) is a huge cashback app that partners with thousands of retailers!

All you have to do is sign up for a free account and then shop through the app or website to receive cash back.

You can also use the Rakuten browser extension to get cash quickly when shopping online.

For in-store shopping, you can link your debit/credit cards to Rakuten and get cash back for in-store purchases.

Plus, when you sign up to Rakuten with my link, you will get $10 for free once you earn $25 in cash back!

It’s free and easy to use, so why not use Rakuten to get back money on things you were already purchasing anyway!

Dosh Automatic Cash Back

One of my favorite cash back apps to use is Dosh, and here’s why…

With many cash back apps, you have to activate offers or go through the cashback app/website to get cash back but not with Dosh.

Dosh will give you cash back automatically for shopping at partnered brands without using their app or activating any offers!

All you have to do is sign up for a free account and then link the debit/credit cards you shop with, and that’s it.

Once you make purchases at retailers Dosh partners with, whether online or in-store, you will get cash back automatically to your account.

I highly recommend checking out Dosh for automatic cash back!

Spend Less On Food With Ibotta

Another great cash-back app that you should use is Ibotta.

Ibotta is similar to Rakuten and Dosh, but it stands out because this is the go-to cash back app for groceries.

Food is one of our most significant expenses, so it’s best to find ways to save money on food whenever possible, and Ibotta is a great option.

Ibotta partners with hundreds of grocery brands where you can get cash back on thousands of items.

You don’t get cash back per retailer but per item; for example, you can get $0.25 cash back on a Chobani yogurt. This doesn’t seem like much, but it quickly stacks up.

People are getting $1,000’s in cash back each year by using Ibotta!

Just sign up for a free account, and then you can start getting cash back on your groceries.

The way Ibotta works is that you have to go into the app and activate offers and then scan your receipt when you are finished shopping to receive your cashback.

It’s definitely more work than Rakuten and Dosh, but it’s worth it, so check it out.

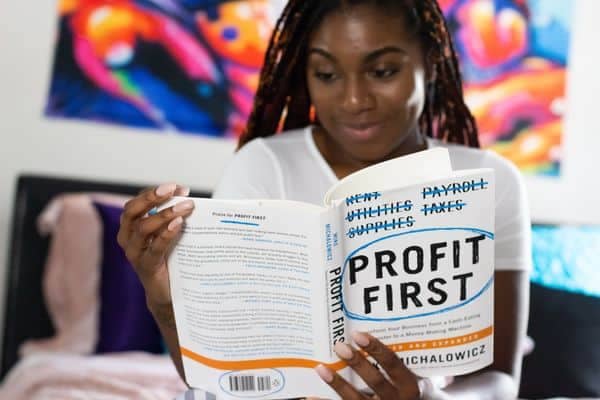

Get Into The Habit Of Spending On Yourself First

If you’re looking for one of the best smart spending habits to reach your financial goals and build wealth, look no further than the mindset of paying yourself first.

Investopedia, the Webster’s Dictionary of personal finance, defines pay yourself first as: “automatically routing your specified savings contribution from each paycheck at the time it is received.”

Essentially the first person or bill being paid when you receive incoming money is yourself and your financial goals.

Those goals are, of course, personal and unique to your situation. However, the mindset is the same.

The money comes in and is automatically distributed to exactly where you want it to go.

That might be some combination of your 401k (RPP), savings account, student loans, mortgage, IRA/Roth (TFSA/RRSP), HSA, RESP, day-to-day checking, and other accounts.

You’re no longer waiting until the end of the month to put whatever is left towards debt repayment, saving, or investing.

The first priority is YOU.

Spend Your Money On Assets

One of the smartest spending habits you should develop is to spend money on assets instead of liabilities or discretionary items.

Most people spend money on the latest tech products, clothing, etc… but not enough on assets that produce an income.

It would be best if you had your money work for you like little soldiers, and you can do this by investing in the stock market, real estate, cryptocurrencies, etc…

I’m not saying you can’t enjoy your life, but you should be conscious about every purchase to make sure it’s really worth it.

The bulk of your money should be invested to grow with compound interest over time.

So, when you get paid, just think about putting money to assets first so your money can make you more money!

Conclusion

These smart spending habits are just a small example of how you can take control of your money and life throughout your personal finance journey.

Personal finances are personal, so you need to find what works for you.

Smart spending habits will help you to save more money to use towards assets which will grow your net worth.

Keep moving forward and make small changes each day that will improve your financial life.

If you like this post then I recommend checking out my posts on How To Manage Your Money Like The Rich and 9 Financial Literacy Topics You Need To Learn About.

Do you have any other smart spending habits to add? Which ones do you use? Let me know in the comments below!