9 Top Investing Apps For Beginners

What are the top investing apps?

Well, before we get to that, let me tell you something…

We are in a new age where you can invest right from your smartphone!

I mean, how awesome is that? There shouldn’t be any excuses like “I don’t have time to invest my money.”

I always get asked, “Where should I invest my money?” I decided to look into low-cost index funds from brokerages like Vanguard or Fidelity.

But…

Honestly, these brokerages are not beginner-friendly and do not have simple-to-use mobile apps, which brings me to this list.

Let’s get straight into these awesome investing apps for beginners!

Best Investing Apps For Beginners

As a beginner, investing can be seen as a scary and risky road to take, but honestly, it is one of the best things you can do in your life!

With that said, this post was put together to show you the best investment apps you can use as a beginner to make extra money in the stock market.

While there are many great investing apps out there, there are three that I believe are the best for beginners getting into investing in the stock market.

These three apps are:

Each of these three apps makes investing in the stock market super easy, and they do all the heavy lifting for you!

Plus, each of these apps has a unique feature, making them perfect to use together.

Let’s dig deeper into these three apps and some other awesome investing apps…

Acorns Investing App

What Is This Investing App?

The Acorns investing app takes your spare change and invests it for you. It’s considered a micro-investing app.

Plus, you can get $5 for just signing up!

So it works like this: you link your debit or credit cards to Acorns (note you will have to use your bank login info to do this, no card numbers).

Then, you can set the cards to do a “round-up”; this means that when you buy anything, Acorns will round up the purchase to the nearest dollar and invest the difference for you!

For example, let’s say you buy a coffee for $5.50 (Starbucks, you’re killing us). Acorns will round up your purchase to $6.00 and automatically invest the 50 cents for you!

Now, of course, 50 cents isn’t going to make you a millionaire, but your spare change sure adds up, so why not make it work for you?!

Note that your spare change isn’t invested as soon as it hits your Acorns account; when it totals $5, Acorns actually invests it for you. So before this $5 limit, your change is sitting idle.

Acorns also allows you to invest lump sums or set up automatic deposits if you want to invest more money (which I highly recommend).

The Acorns investing app is free for college students for four years; you must have a .edu email address, and your employment status needs to be “student.”

The pricing for Acorns is $1 a month for a taxable account; if you reach $1 million in your Acorns account, it is $100 per month for each million!

For retirement accounts, you are charged $2 a month; for all Acorns features, you are charged $3 a month. For more information, go here.

Acorns offers a user-friendly mobile app for beginners to start investing in diversified portfolios with automated investing, fractional shares, and free features, ensuring a seamless trading experience without worrying about high fees or minimum balances.

Acorns is one of the best apps to invest in for beginners due to its simplicity! Let’s head into the pros and cons.

Pros

- There is no minimum to open an account; you just need $5 to invest

- $5 bonus for signing up!

- Contains diversified portfolios

- Made up of low-cost ETF funds

- Easy to use the app

- Automated investing

- Found money and education portal

- Supports retirement accounts

- Secure and insured by SIPC

Cons

- Limited investing options (prebuilt portfolios)

- Can’t invest in individual stocks

- Fees can add up and become more expensive than investing in index funds.

Who Is This Investing App For?

If you are a college student then you should definitely use the Acorns investing app since you get to invest for free for four years! Also, Acorns is one of the best investment apps for beginners who are just starting out and want to ease their way in.

Even if you are an experienced investor and want a passive way to invest, Acorns might be the app for you.

You can sign up for Acorns here and get $5 for free!

Robinhood Investment App

What Is This Investing App?

The Robinhood investing app is based in the U.S., allowing you to buy and sell stocks for free! Yes, you read that right, absolutely free!

This investment app is straightforward to use, and they have also started supporting crypto; yes, you can invest in Bitcoin, Ethereum, etc… from the Robinhood app (if that’s your cup of tea).

Using Robinhood to invest in Cryptocurrencies is supported in most states but not all at this time.

Robinhood is a great way to start trading in the stock market, and there are no commissions to trade stocks!

To sweeten the deal, when you sign up for your free Robinhood account with my link you will get a free stock like Apple or Facebook, just for signing up!

Along with all this great news, there is more! Robinhood now also offers fractional shares, which means you can buy pieces of stocks instead of a whole stock if it’s pricey.

They are also launching a cash management account where you can store your cash and earn interest on your money! This is in the works, but you can join the waitlist.

Robinhood also has a premium version called Robinhood Gold, which starts at $5 a month. This gives you access to more research tools, instant deposits, investing on margin, etc… but as a beginner, I say stick with the free version now.

Robinhood’s mobile and desktop trading platforms allow beginners to start investing in stocks with no minimum balance, providing access to various investment options, including fractional shares, all with free trading and minimal fees.

Pros

- Easy to use and simple to setup

- Free stock bonus!

- Commission-free trading

- SIPC insured

- Crypto support

Cons

- Limited tools and analytics

- Limited securities (no mutual funds or bonds)

- No dividend re-investment option

Who Is This Investing App For?

The Robinhood investing app is one of the best investment apps for beginners who want to gain some exposure in the stock market. The commission-free trades are refreshing and offer a great incentive to use their platform.

Experienced investors may find that Robinhood lacks the tools for stock analysis and may find that a more prominent broker like E-trade or Fidelity better fits their needs even though they have to pay a commission to trade.

Even if you are an experienced investor, you can use analysis tools outside of Robinhood and then trade in Robinhood to take advantage of the zero commissions. Why not?!

Robinhood may lack the tools for in-depth stock analysis, but it wants to expand, so it is a platform to keep your eye on!

Due to the ease of use, the free stock bonus, the simple app interface, and commission-free trading, Robinhood is definitely one of the best apps to use!

Sign up for your free Robinhood account here and get a free stock!

Stash Investing App

What Is This Investing App?

The Stash Invest app allows you to invest in individual stocks and ETFs. You can invest with as little as $5.

There are no commission fees to buy/sell stocks or ETFs on the Stash app, but there is a $1 monthly fee for using the Stash app, just like Acorns.

For retirement accounts, you will have to be part of the Stash Growth plan, which costs $3 a month, or the Stash+ plan, which costs $9 a month.

With the Stash+, you will get access to all features and the option to invest on a child’s behalf, which is pretty awesome!

Stash also offers a cash account that is available to you in all of their plans, but their cash account is fascinating and much different than Robinhood’s.

With the Stash bank account, you will not earn interest on your money. Instead, you can be part of their stock-back rewards program, which lets you earn stocks/funds for your purchases with the Stash debit card!

For example, if you spend money at Walmart with your Stash debit card, you will get 0.125% in Walmart stock added to your Stash portfolio. You can even get 5% in stock-back for some merchants!

Stash also lets you invest in fractional shares of ETFs and individual stocks, which is great because, let’s say, you would like to invest in Amazon, but you can’t afford to invest $2,012 (the price of one share as of writing this) then you can invest $5, $20, $100, etc…

Stash’s user-friendly mobile trading platform empowers beginners to start investing with low minimum balance requirements and access to a wide range of investment options, including fractional shares, all while offering personalized financial planning features and minimal fees.

Let’s go over the pros and cons of the Stash Invest app.

Pros:

- Only $5 is needed to start investing

- Good investment in education resources on the app

- Simple to use and navigate

- Stock-Back program

- SIPC Insured

Cons

- No web platform

- High fees for low balances

- Lacking analysis tools

Who Is This Investing App For?

The Stash Invest app is for people who are new to investing and want to invest effortlessly. Also, if you don’t have a lot of money to invest, then Stash can be the app for you due to its low fees, zero commissions, and fractional shares.

If you are beginning your investing journey, then Stash is a good app to look into; they walk you through your investment options and make it easy to build a portfolio right for you.

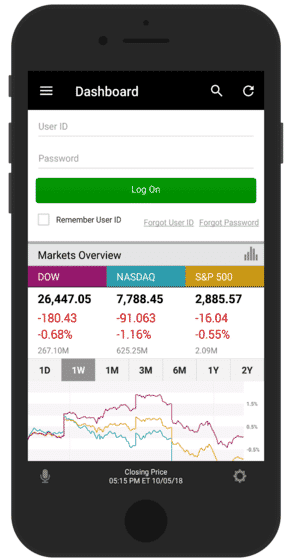

E-Trade App

What Is This Investing App?

E-Trade is another investing app, but what sets it apart from other investing apps is that E-Trade is a very well-known brokerage that has been around for years.

Along with their app, they have a web platform with many analysis tools for in-depth stock research.

E-Trade has many more options than other investment apps, but this comes with an expense, yes, the fees!

E-Trade provides a comprehensive suite of trading platforms, including mobile and desktop trading options, offering both beginners and experienced investors a wide array of investment options, such as fractional shares and personalized financial planning features, with competitive commissions and fees.

They are more expensive than other investment apps, but if you need all the bells and whistles, then E-Trade might be the app for you.

Pros

- Research tools

- Availability (app & Web platform)

- Investment options

- Customer service and support

- SIPC Insured

Cons

- The interface can be confusing to new investors

- High trade fees

- $500 account minimum

Who Is This Investing App For?

I believe E-Trade is one of the best stock trading apps for intermediate to advanced investors. It really doesn’t make sense for beginner investors to use this platform if they aren’t going to use all the tools available because the commission rate is pretty high.

If you used other investing platforms before but feel you need more advanced research tools, then E-Trade is an excellent choice for you!

Charles Schwab Investing

What Is This Investing App?

Charles Schwab is another investment brokerage that has been around for years, and they are very similar to E-Trade, but they have started to take a more modern approach to investing, competing with newer companies such as Robinhood.

Here’s what I mean…

Charles Schwab has no account minimum, and they cut their fees to $0 for buying and selling stocks and ETFs!

This is a highly trusted company that has been around for a long time, and they are competing with some of the newer sought-after apps. This is a brokerage worth checking out!

Pros

- Research tools

- No commission on trades

- App and Web platform

- Customer service

- Investment options

- SIPC Insured

Cons

- The app can be confusing

- Some mutual funds have high fees

Who Is This Investing App For?

Like E-Trade, Charles Schwab is suitable for intermediate to advanced investors. While they are much cheaper than E-Trade, they still have an educational barrier than other apps on this list.

So, if you are not going to utilize all the tools and investment options, it might be better to look elsewhere, but if you are ready to become a pro, Charles Schwab might be just what you need.

Wealthfront Investment App

What Is This Investing App?

Wealthfront is a bit different from the apps we have gone over so far because Wealthfront is considered a robo-advisor.

A robo-advisor is basically just a computer that uses sophisticated algorithms to manage your investments. They offer low fees, and Wealthfront is one of the best passive investing apps out there!

Wealthfront has a minimum investment amount of $500 and charges 0.25% per year as a management fee.

Luckily for you, If you sign up with my link you will get your first $5,000 managed for free, yes no fees for you on your first $5,000!

Along with the easy-to-use investment account, Wealthfront also offers a cash account that has one of the highest interest rates you can find! When writing this, the Wealthfront cash account is 1.82%, which is 18x higher than the national average!

This is one of the best ways to grow your money. Plus, your cash in this account is FDIC-insured for up to $1 million!

Wealthfront’s innovative platform offers automated investing, focusing on diversified investment options, including fractional shares and personalized financial planning features, with minimal fees and low minimum balance requirements, making it an ideal choice for beginners and seasoned investors.

Wealthfront makes it super easy to invest. I mean, they do all the work for you for super low fees, and now they are paying you money for just having a cash account with them! Plus, you will get your first $5,000 invested for free!

Let’s get into the pros and cons.

Pros

- Low fees (free up to $5,000 with my unique link)

- Simple to use

- Passive investment

- App and Web platform

- 529 account support

- SIPC Insured

Cons

- No fractional shares

- No human advisors

Who Is This Investing App For?

I believe anyone can use Wealthfront! With your first $5,000 managed for free with my link, why not?

If you are a more hands-on investor, then Wealthfront might not be suitable for you, but if you are looking for a hands-off approach to investing with low fees and complications, then Wealthfront can be just what you are looking for!

Due to the passive nature of Wealthfront, I believe it is one of the best investment apps for beginners.

Sign up for Wealthfront here and invest your first $5,000 for free!

Wealthfront is one of the best investing apps if you want to invest using a robo-advisor.

Coinbase Investing App

What Is This Investing App?

Coinbase is different from the other apps because Coinbase is an app used to invest in cryptocurrencies!

Yes, Robinhood is getting into Cryptocurrency, but they are currently limited in who can invest in cryptocurrency. Coinbase welcomes all in over 100 countries!

If you are interested in investing in cryptocurrency, then Coinbase is the app for you! They have been around for a while and are among the few trusted Crytpo brokers.

Also, when you sign up for Coinbase with my link you will get $10 worth of Bitcoin when you buy at least $100 worth of any cryptocurrency!

There is also another way to earn free cryptocurrency on Coinbase…

Coinbase has launched a learning portal with courses on different cryptocurrencies, and when you complete a course, you will get rewarded with a certain amount of cryptocurrency that you learned about!

This is great for beginners who want to learn about crypto.

Coinbase, a popular cryptocurrency exchange, offers a user-friendly mobile trading platform with a range of investment options, allowing beginners to start investing in digital assets like Bitcoin and Ethereum, all while providing personal financial management features and competitive trading fees.

Sign up for your free Coinbase account here.

Pros

- Very easy to use

- Free Bitcoin with investment

- Low fees compared to other Crypto brokers

- Considered safer than other brokers

- App and Web platform

- Has a trading platform called Coinbase Pro for cheaper fees

Cons

- Limited Cryptocurrencies currently

- Slow customer service

Who Is This Investing App For?

Coinbase is for anyone who wants to invest in cryptocurrencies!

I have to warn you: nobody knows where crypto is going! We had a big crash in the crypto market, and it can get worse or better; nobody really knows.

So, invest in crypto with extreme caution. Do not put all of your money in crypto! Only invest what you can afford to lose; while blockchain technology is promising and looks like it is here to stay, nobody knows which coin will make you money.

I invested only a little bit of my money in crypto, and it would suck if I lost all of it, but I planned for it and chose to take the risk.

If you are willing to take the risk in crypto, please plan it out, and if you do choose to invest, then definitely start with Coinbase!

Coinbase is one of the best apps to use for investing in cryptocurrencies.

Stockpile App

What Is This Investing App?

Stockpile is a unique investment app because while you can buy and sell stocks directly, you can also buy a gift card.

So, if you want to give stocks as a gift, then Stockpile is a great app to sign up for.

For example, if you want to buy $100 worth of Apple stock as a gift, Stockpile will give you a $100 Apple gift card (no, not one to spend on products); this is to buy the stock strictly.

So instead of buying gifts that nobody uses, you can give stock gift cards to make them some money!

Stockpile has no annual fees; their commission to buy and sell stocks is just $0.99 per trade! This is extremely low!

If you want to gift a stock, then you will have to first pay for the stock, and you will have to pay $2.99 for the first stock you gift and $0.99 for each additional stock. You also need to pay a 3% credit/debit card fee.

So, that $100 Apple stock gift just became $105.99, but your fee drops $2 after your first stock.

Stockpile offers a unique approach to trading by allowing investors to buy fractional shares of stocks through a user-friendly mobile app, making it a great choice for beginners with no minimum balance requirements and minimal fees, providing a personalized financial experience.

Let’s head into the pros and cons.

Pros

- Unique and easy way to give stocks

- Low trading fees

- SIPC insured

- No annual fees or minimum balance

- Offers fractional shares

Cons

- No retirement account options

- Only available to U.S residents

- No mutual funds or bonds

- Gift cards are worthless if Stockpile goes out of business

Who Is This Investing App For?

Stockpile is a unique investment app that can work for anybody. The selling point of Stockpile is the ability to give stocks as a gift to anyone.

You can buy individual stocks and ETFs for only $0.99, but you can use Robinhood and do it for free. The thing is that with Stockpile, you get to invest in fractional shares, which can work out better.

I have a Stockpile account, and while I don’t use it that much, it’s an excellent app to have. There are no fees for having an account, so why not?

Betterment Investing

What Is This Investing App?

Betterment is another robo-advisor just like Wealthfront, but what sets them apart is that Betterment has no minimum balance, offers fractional shares, and has human advisors.

Wealthfront offers a 529 plan, and they also have a REIT you can invest in for further diversification.

Both robo-advisors boast a 0.25% management fee, but remember that if you sign up with my Wealthfront link, you get your first $5,000 managed for free!

Betterment’s platform offers automated investing with a wide range of investment options, including fractional shares, making it an excellent choice for beginners looking to start investing with a low minimum balance requirement and minimal fees, all while providing personalized financial planning features.

Let’s get into the pros and cons:

Pros

- Low Fees

- Simple to use

- Passive investments

- Diversified portfolios

- SIPC Insured

Cons

- No REIT support

- Not suitable for active investors

- The premium plan is pretty expensive

Who Is This Investing App For?

Betterment can work for anyone. It is one of the best passive investing apps, offering fractional shares, which is excellent for beginners.

Even though Betterment seems to have low fees at only 0.25%, it is still a bit more expensive than other investing brokerages out there.

If you want to invest in a robo-advisor, I recommend going for Wealthfront, which lets you invest $5,000 for free with my link!

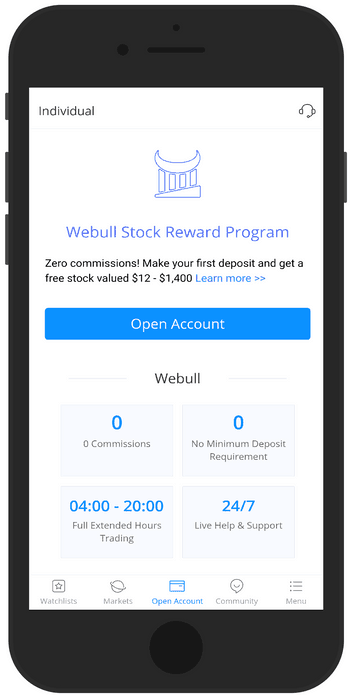

Bonus – Webull App

We already went over nine apps, but one of the best investing apps you can use right now is Webull, and it is the bonus app in this post!

Webull is an excellent app that you can use to invest your money in the stock market easily and, best of all, for free!

Yes, that’s right, with Webull, you can buy and sell stocks for free, and no minimum deposit is needed.

Webull is similar to Robinhood, but Webull has much more advanced stock analysis tools and is available in India and China as well as the U.S.

Also, when you sign up to Webull with my link you will get a free stock!

And get this…

When you deposit any amount to Webull from your bank account, you will get another stock for free!

As shown in the image above, this is a limited time only, so I recommend you take advantage of this fantastic deal before you miss out; what do you have to lose?

The free trades of thousands of stocks and ETFs, no minimum deposit, and advanced analysis tools make Webull one of the best investment apps for beginners!

Remember to sign up with my link to get your free stocks, and then invite your friends to get more free stocks!

Conclusion

There you go, these are 9 of the top investing apps to use right now!

These apps are great for beginners since they are convenient and easy to use, but honestly, you shouldn’t rely solely on these apps to invest your money.

You should really look at investing in index funds in a brokerage like Vanguard, which offers really low fees, or Fidelity, which now offers no-fee index funds!

So, I recommend signing up for your free Robinhood account here so you can invest in individual stocks without any commissions. Also, when you sign up with my link, you will get a free stock!

Then sign up for your free Wealthfront account here and get your first $5,000 managed for free!

After you get comfortable investing your money, I highly recommend looking into Vanguard or Fidelity.

If you like this post, I recommend checking out my posts on Where To Invest Money To Get Good Returns and Characteristics Of Investors: How To Become A Successful Investor.

The truth is that even though fees matter, what matters more is investing your money. So, test out a few apps and see which one works for you!

Do you use any of these apps? If so, what is your experience with them? What is the best investment app, in your opinion?

Just a reminder, all points in this post are my opinions gathered from research. I have recommended products to use, but these are based on my preference and should not be misconstrued as financial advice. If you have any investment questions, please seek a financial advisor.

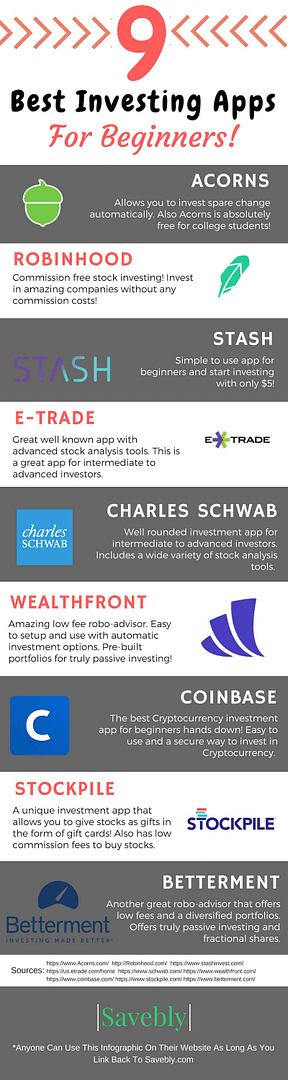

I created this awesome infographic to summarize the critical points in this post. If you have a blog or website, feel free to use this infographic. Just link back to this article somewhere in your post. (Download the investing apps infographic here.)

There is very good content on your blog, I was truly delighted with this information.

Thanks for reading!