Equal-Weighted Vs. Cap-Weighted Index Funds

Index funds are seen as the holy grail of investing by many beginner investors and personal finance bloggers but one thing that people don’t really mention is that there are two types of index funds.

Yes, you heard that correctly. There are two types of index funds, they are equal-weighted vs. cap-weighted funds.

It’s important to know the difference between these two types of index funds because owning one versus the other can affect your portfolio performance and diversification!

The main difference between equal-weighted vs. cap-weighted funds is the allocation of your money to the funds’ holdings.

This causes these two types of index funds to have different performances over time and it also affects the diversification of the index fund.

So let’s get straight into equal-weighted vs. cap-weighted index funds and why you should care!

Diversification

The nature of cap-weighted index funds is not as diversified as you think.

What this essentially means that when you invest in a cap-weighted index fund like the Vanguard S&P 500 fund (VIFAX) you are placing most of your money in the top 10 holdings because they have the highest market cap.

For example, at the time of writing this, the top ten holdings in VFIAX account for 23% of the total net assets. What this means that if you invest $100 in VFIAX $23 will be split up among the top 10 holdings but not evenly.

So, $77 will be left to split up among the 499 other holdings in VFIAX. (Vanguard states there are 509 holdings in VFIAX)

To get a better understanding of this, Morningstar states that Apple (the number one holding in VFIAX) has a portfolio weight of 7.08% and VFIAX’s 25th holding Costco has a portfolio weight of 0.68% (at the time of writing this).

This means that for every $100 you invest in VFIAX, $7.08 is invested in Apple and only $0.68 is invested in Merck & Co Inc. (keep in mind that this is only the 25th holding! The last holding will probably get less than a penny invested out of $100!)

Now is this a bad thing?

Well, it depends…

Some people say that cap-weighted funds are safer because you are heavily invested in larger companies which are seen as safer investments than smaller cap companies.

But…

On the other hand, some people say that equal-weighted funds are safer because you are equally diversified in many different companies in different sectors.

Then again, equal-weighted funds can be seen as more riskier because you are more invested in smaller companies which carry more risk and are more volatile.

So, you can see this is not a simple decision because even though equal-weighted funds are more diversified this doesn’t always mean they are safer investments.

Before you make a decision on what type of index fund you are going to invest in, let’s see compare the performance of equal-weighted vs. cap-weighted index funds.

Performance

So which fund performs better? Well again, it’s not that simple.

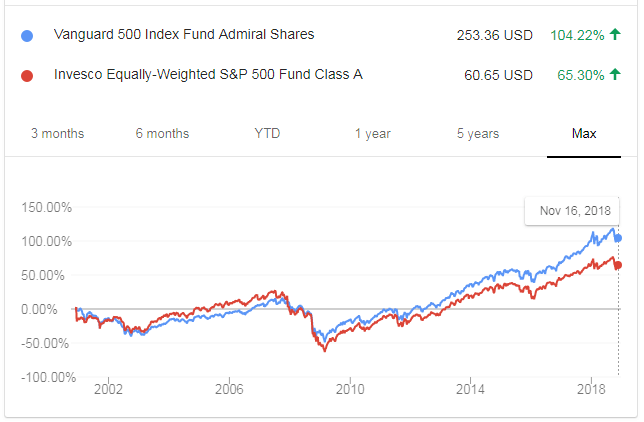

I compared the VFIAX and VADAX and from my research, I found that the VFIAX performed better over a 10 year period.

But, Forbes did a similar study and found that VADAX performed better than the VFIAX

You also have to take into consideration the expense ratios and turnover rates. Equal-weighted funds have higher expense ratios and turnover rates which can eat into your returns.

In fact, the VFIAX fund has an expense ratio of only 0.04% while the VADAX fund has an expense ratio of 0.53%.

Now this may not seem like a big deal, I mean if you invest $10,000 in the VFIAX your fee will only be $4 and if you invest $10,000 in the VADAX your fee will be $53.

Not a jaw-dropping amount on $10,000 invested.

I can understand if you pay a larger fee for better returns but from the comparison seen earlier, you will actually pay more fees for fewer returns.

The numbers speak for themselves when it comes to the comparison over a 10 year period but you need to know that it isn’t always going to be this way.

Equal-weighted index funds are seen as a better performer because you are invested more in smaller companies that have more room to grow than larger companies in the index.

But…

As I stated before, this can be riskier. So, you really need to know your risk tolerance before choosing which type of index fund to invest in.

Cap-Weighted Funds

Let’s go over the pros and cons of cap-weighted index funds.

Pros

- Less of a risk because most of your money allocated to larger and more stable companies.

- Low turnover rate and low fees.

- Widely available.

Cons

- Not as diversified as equal-weighted funds.

- Overweight in a few large market cap companies.

- Misses on the growth of smaller cap companies.

Equal-Weighted Funds

Now let’s go over the pros and cons of equal-weighted funds.

Pros

- More diversified allocation of money

- Can perform better in theory because you are more invested in smaller companies with more room to grow

Cons

- High turnover and higher fees than cap-weighted index funds

- More volatile due to more money allocated to smaller companies

- Not widely available as yet

Conclusion

Now that you know there are two types of index funds, which one do you choose?

In theory, equal-weighted index funds seem like a better choice because you get to be more diversified and you can potentially get higher returns but the comparison shows differently.

I definitely know that past performance doesn’t indicate future performance but it can give a good overview of how the funds compare to each other.

And…

The comparison shows that the cap-weighted index fund still reigns king. Of course, it still has its downsides as I described in my post on the problem with index funds but overall they are really great investments.

If you would like to know more about index funds check out my post on the best reasons to invest in index funds.

So which index fund do you think is better? What else can you add on comparing equal weight vs cap weight index funds?