Seasonal Investing: What It Is & How It Works

What is seasonal investing? How does it work and how do you do it?

I know you have a lot of questions about this investing method so we’ll go into depth to answer all your questions.

There are investors who use seasonal investment strategies to get better returns than the market.

So, it’s a method that’s definitely worth knowing about so keep on reading!

Let’s get into it…

What Is Seasonal Investing?

Seasonal investing is an investing strategy that uses historical data to “predict” how certain stocks or sectors are going to perform during a specific time period.

For example, let’s say that energy stocks tend to perform better than the broad market from January to April so you invest in energy stocks during this time to get a better return on your investment. (this is just an example, not factual)

Even though the example above isn’t derived from facts you get the point and seasonal investing is derived from historical data but just know that past performance does not indicate future results.

When it comes to seasonal investing, there are some common concepts people follow although the validity of such concepts has been questioned more recently.

For example, a common theme that has been followed for many years is Sell-in-May-and-Go-Away, which suggested that investors can get better returns if they stay invested only between October and May.

This was suggested because markets were fairly depressed during the summer months when people preferred being outdoors enjoying the good weather.

However, we have seen that this is not necessarily true over the last few years.

Investors who sold in May missed out on a great rally during the summer months.

The reason is quite unknown although I suspect either the presence of QE or increased buybacks from companies.

The other reason I suspect is the access to technology and the stock markets. With the advancements in technology, investors are now able to access and stay on top of the markets anytime anywhere.

Irrespective of the reasons, there are still some seasonal trends when we watch closely.

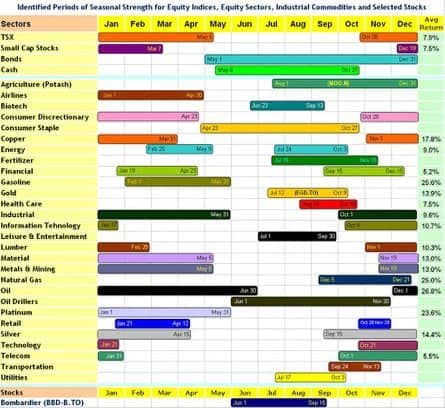

The chart below shows the period when certain sectors perform the best and you also get to see the average return for certain sectors during this period.

Some industry experts are confident enough to pinpoint whether the season starts at the beginning, middle, or end of the month.

However, take this data with a grain of salt because things change and while seasonal investing is based on historical data there is no guarantee that this year will be the same as last year

Let’s dig deeper into seasonal investing to see if you should use this strategy…

How To Do Seasonal Investing

Using the chart that we went over earlier, you can see the trends for certain sectors and the periods where certain sectors outperform others.

So, how can you use this to your benefit?

One way to do this is to do your research (not just going off the chart above) and come to an educated guess on which sectors to invest in for a certain time.

You can then sign up for Webull and then invest in sector-specific ETFs at beginning of its season and then sell-off at the end of the season.

Plus, when you sign up to Webull with my link you will get 2 free stocks just for signing up!

Now, the method of seasonal investing can be a little trying because you have to constantly adjust your portfolio to fit the season.

However, you can choose to invest in the Pacer CFRA-Stovall Equal Weight Seasonal Rotation ETF (SZNE) which is an ETF that focuses on seasonal investing and does all the work for you.

You can invest in this ETF using Webull or any other broker that you are comfortable with.

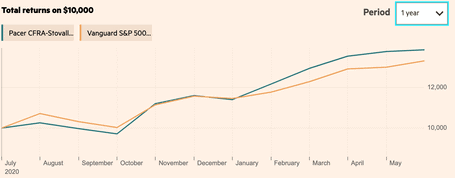

Now, let’s compare the performance between SZNE and an ETF that tracks the S&P 500 like the VOO.

As you can see from the comparison above the SZNE outperformed the S&P 500 for the past year which is great for seasonal investors.

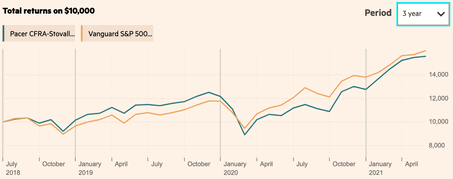

However, if you extend the chart to 3 years then you can see that the VOO outperformed the SZNE.

Since SZNE only started in 2018 we can only compare the performance for the past 3 years but it seems that the more time you compare SZNE to VOO, the S&P 500 ETF will outperform.

Is Seasonal Investing A Good Strategy?

Now that you know what seasonal investing is and how to use it the big question is if you should use seasonal investing.

Seasonal investing can be a good strategy and it has historical data to back it but there is one big issue with seasonal investing and that is that future results cannot be predicted.

Yes, certain sectors historically perform better at certain periods which seasonal investing is all about but there are a lot of other factors to consider.

It’s risky to allocate all of your money to seasonal investing but it can be a great strategy to use as part of your portfolio.

I recommend having most of your money in an S&P 500 index fund or total market index fund and allocating some money to a seasonal investing ETF like SZNE.

You can also use Robinhood or Webull to invest in individual stocks you think will have high returns for a specific season.

Pros and Cons Of Seasonal Investing

Let’s quickly list out the pros and cons of this investing method:

Pros

- Seasonal investing is based on historical data trends.

- Certain companies and sectors are based on seasonality so you can get higher returns by investing in these sectors or companies at certain periods.

Cons

- This method relies greatly on timing the market and even though it’s backed by data, perfectly timing the market is not possible.

- Unless you invest in a seasonal ETF, this method is very active because you will have to constantly buy and sell stocks.

- There are many other factors to consider for this method that is not included in the data.

So, these are the pros and cons of seasonal investing and you can use these to decide if this method is right for you.

Conclusion

Now you know what seasonal investing is and how it works you now need to decide if it’s the right strategy for you.

Investing seasonally is not a holy-grail method, it has its downsides and risks so just approach this method cautiously.

It is a method that is backed by historical data but as you know, past performance is not an indication of future results and there are many other factors to consider.

Plus, if you choose to opt for a seasonal investing ETF then be sure to check out the ETF fees because the fees can eat up your profits!

If you liked this post then I recommend checking out my posts on Aggressive Investing and How To Invest In A Bear Market.

Have you tried seasonal investing? What are your thoughts on this investing method? Let me know in the comments below!