Simple IRA and Roth IRA Facts

There I was at my job, you know… doing work stuff. I had already set up my contributions in my 403b but then I started to have a few questions like I always do.

What if I leave this job and the new job’s retirement options suck? What if I want to be self-employed? Or what if I max out my contributions to my 403b and I still want to invest for my retirement?

Well, luckily there is the IRA out there, which stands for Individual Retirement Account.

An IRA can be a great option for you depending on your circumstances.

Let’s dig a little deeper to see what this IRA thing is all about and see if it is right for you.

Overview

Now what exactly is the IRA and why is it different from a 401k/403b?

An IRA is similar to a 401k but it isn’t tied to your employer.

It places the control in your hands.

An IRA can be opened with a variety of investment companies, such as Vanguard and Fidelity.

Both IRA’s and Roth IRA’s typically have more investment options than 401k’s.

Contributions

In 2022, both IRA’s and Roth IRA’s have a maximum contribution of $6,000 or $7,000 if you’re age 50 or older.

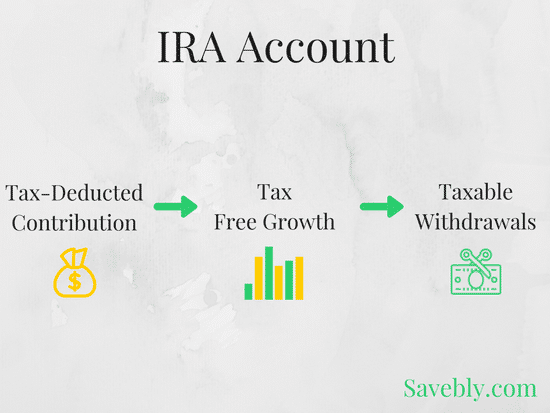

IRA contributions are also tax-deductible, but they have some caveats that may cause you to only have partial deductions or no deductions at all.

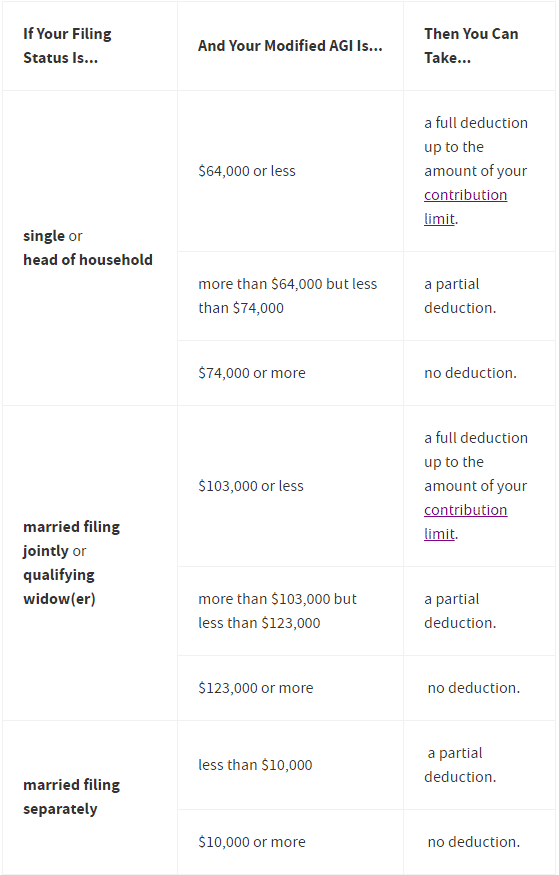

- If you are covered by a retirement plan at work then these are the deduction limitations:

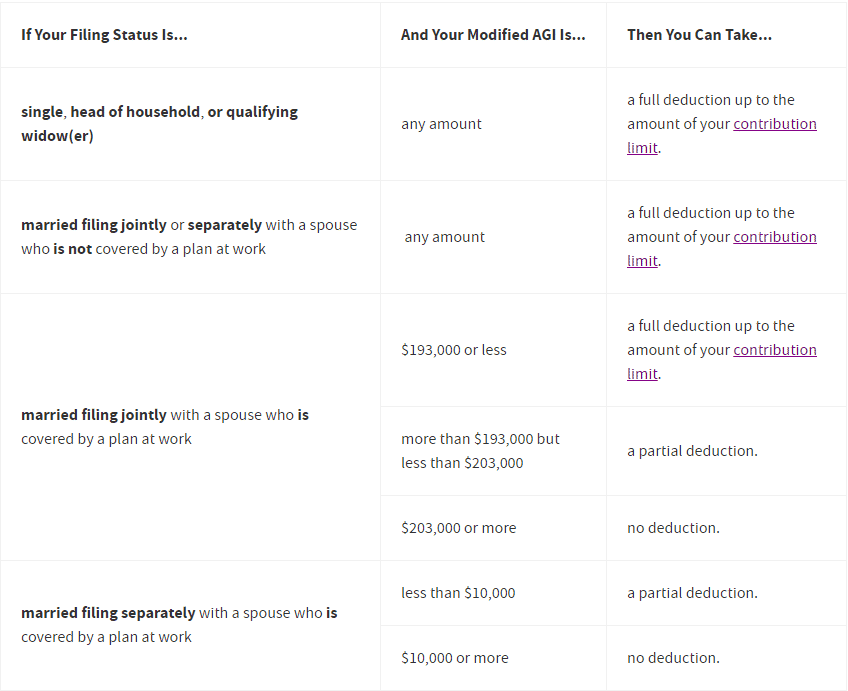

- If you are not covered by a retirement plan then these are the deduction limitations:

You are not able to make contributions to an IRA if you are 70.5 and older but you will be able to make contributions to the Roth IRA regardless of your age.

IRA vs Roth IRA

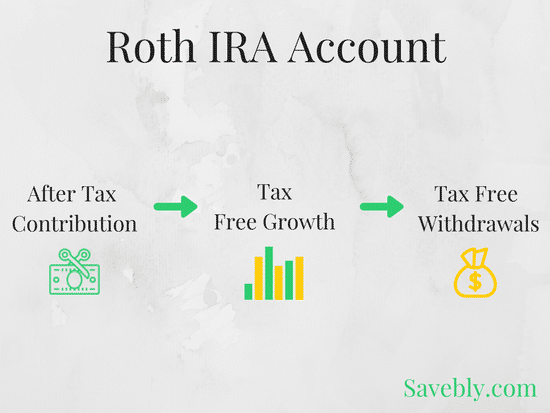

A Roth IRA is essentially the same as an IRA, but the difference is that in a Roth IRA you contribute after-tax income without any tax deductions and you get tax-free withdrawals.

Simply:

And these are the Roth IRA facts…

Roth IRA Income Limits

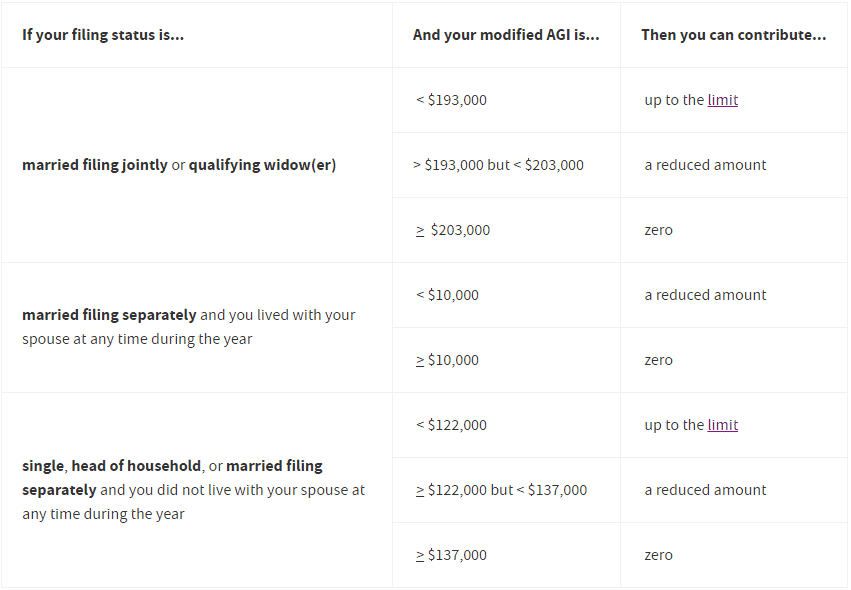

A key point to remember is that the Roth IRA has income limits that determine your eligibility to participate, and this can be seen below:

Withdrawals

For both the IRA and the Roth IRA, the minimum age for withdrawals without a penalty is 59.5.

If withdrawals are taken out before 59.5 the withdrawal is subject to a 10% early distribution penalty in addition to income tax.

For the IRA you must start taking withdrawals at age 70.5 but for the Roth IRA, no withdrawals are required until the death of the owner.

Can you Invest in a 401k and an IRA at the same time?

Yes, you can! Jon Stein, CEO of betterment explains this beautifully in this video. Take a look.

Important things to remember

- Shop around at different investment companies for your IRA or Roth IRA, and choose funds with low fees and a diverse portfolio.

- Remember the income limitations of the Roth IRA, the contribution limits of the IRA and Roth IRA, and the tax deduction limitations of the IRA if covered by an employer or if not covered.

- Take note of the withdrawal limitations for the IRA and the Roth IRA.

- Consider investing in target-date funds that consist of different index funds for diversity.

Conclusion

I feel the yawns, but I am glad you got through it!

This is valuable information that can be used to make you a great deal of money.

IRA’s and Roth IRA’s are great investment options for those who are self-employed or are looking for an additional investment option other than the 401k.

Constantly check the IRS website for IRA/Roth IRA updates. Also, please consult with your financial advisor and tax professional before making any decisions.

That’s it!

Make sure to check out my post on the 401k/403b.