Rocket Money Review: Save $100’s On Bills Right Now!

After this Rocket Money review (formerly Truebill), you will see if this app is right for you to save money…

I know saving money can suck at times, but honestly, if you aren’t saving money in every way you can, it is going to be hard for you to improve your financial situation.

But…

You don’t have to be alone when it comes to saving money; there are many services out there that will help you tremendously when it comes to saving money and managing your finances.

This is where Rocket Money comes into play!

If you want to save money automatically by doing a minimal amount of work, then Rocket Money is the app for you!

Financial apps might worry some people and if you ask yourself, “is Rocket Money safe?” the answer is yes, as you will see throughout the post.

Rocket Money is an awesome app that you can start using for free right now to save money! Let’s dig deeper into what Rocket Money is and how to use it…

Rocket Money (Formerly Truebill) Review

In this Rocket Money review, you will get all the details about Rocket Money to see why you should use this app to save money and manage your finances.

The Rocket Money team knows that managing your money can be hard; that’s why Rocket Money is made to be as easy and as simple as possible.

And the thing is…

The Rocket Money team did a great job making the app simple to use!

I recommend signing up for Rocket Money so you can follow along in this post to see how Rocket Money can save you money.

Let’s get into what Rocket Money is and how it works…

What Is Rocket Money?

Rocket Money is an awesome app that will not only help you to save money but also help you to manage your finances as a whole!

The way Rocket Money saves you money is by finding and canceling subscriptions you are paying for that you’re probably not using and also by negotiating your bills!

In fact, Rocket Money has helped its customers save over $14 million by doing these services.

The cool thing about Rocket Money is that it also helps you manage your finances by setting budgets and savings goals!

Rocket Money is an awesome app that can help you save money all around; let’s continue this Rocket Money review to see how Rocket Money works to save you money…

How Does Rocket Money Work?

The first thing you need to do is to sign up for Rocket Money for free here!

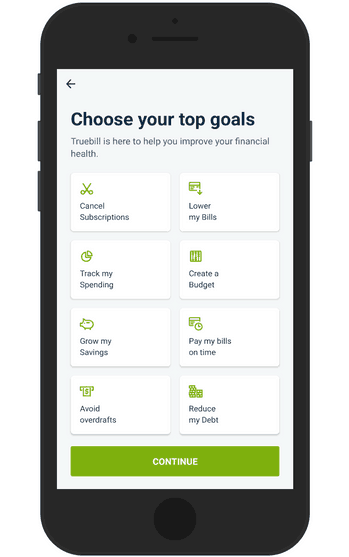

You will then need to select your primary goal using Rocket Money. Your primary goal can be to cancel subscriptions, lower bills, track spending, create a budget, etc…

Here are all the options to choose from…

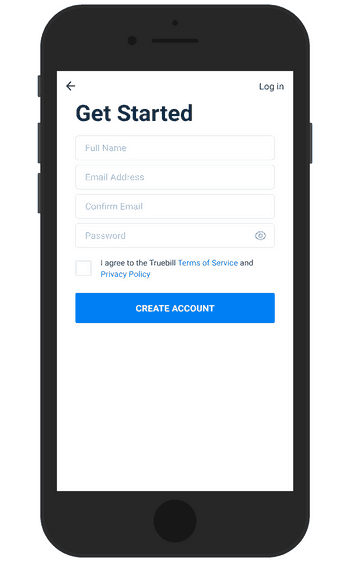

Then just fill out the details listed below to create your free Rocket Money account.

After filling in your details, you will have to enter your phone number to verify your account. You will get a code via SMS, which you just have to enter into the app.

Next up is the part that scares most people, but there is no need to worry…

You will now need to link your bank accounts or credit cards you use to shop with to Rocket Money so the app can analyze your spending and help you save money.

The part that scares most people is that you will need to use your bank credentials to link the accounts to Rocket Money instead of card numbers.

As I said before, don’t worry at all…

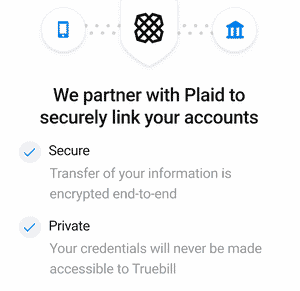

Rocket Money uses a financial encryption service called Plaid to link your bank accounts to their app.

It might be strange using a third-party service for this, but Plaid is a legit company that works with brands like Robinhood, American Express, Acorns, etc…

Plaid uses high-level encryption to ensure your data and information are safe and never accessed in plain text.

You can start with one bank account or credit card for now and add others later on.

I do recommend linking all the accounts you use to shop with, so you can maximize your savings!

You should now be at the home screen so let’s go over the specific ways Rocket Money will save you money!

Lowering Bills

One of my favorite features of Rocket Money is that they work on your behalf to negotiate for a lower rate on your bills!

This is so awesome, and I highly recommend that you use this feature.

Rocket Money negotiates with many service providers most being telecom services like Comcast, Verizon, Spectrum, Sprint, etc…

While it’s not a diversified set of services, they are services most of us use and pay an arm and a leg for!

To use this feature in Rocket Money, you will need to upload a copy of your bill to the Rocket Money app\website or link your online account to Rocket Money.

Rocket Money will then work to negotiate a lower rate on your bill for you. This can be getting a promotional plan, cutting out fees, or lowering the bill entirely!

This is awesome, but it is not entirely free. Rocket Money will take 40% of your annual savings if they are able to save you money by negotiating.

If they aren’t able to save you money on your bills, then you will not have to pay anything.

How does Rocket Money negotiate bills? The way it works is like this…

Let’s say you have Verizon FIOS, and you link your account to them, and they are able to save you $100 a year on your bill; you will have to pay Rocket Money $40.

The downside is that you will have to pay Rocket Money right away out of your linked accounts which is pretty much taking a loss for this month.

You will then see your savings add up over the year, eventually saving more than you’ve paid Rocket Money.

While it might be a bit of an inconvenience to pay upfront Rocket Money upfront, they are doing all the work for you, and you save more than you lose, so that’s a big win!

Monitor Subscriptions

The service that most people use Rocket Money for is to monitor and cancel unwanted subscriptions.

It’s crazy that many people pay for subscription services they don’t even use!

Rocket Money will help you analyze your spending to find which subscriptions you are paying for, and you can decide if you want to cancel the subscriptions or not.

To let Rocket Money analyze your spending, you will need to link your bank accounts to Rocket Money using Plaid, which you have probably done already; if not, then you need to do it for this service to work.

Rocket Money will then review all your transactions to find reoccurring bills and then map them to a calendar within the Rocket Money app so you can see all your subscriptions in one place.

The calendar will have the transaction date for the subscription and the price.

This visual representation is fantastic because you will get to see how many subscriptions you are actually paying for and how much they cost.

You can then cancel the subscriptions you no longer need by contacting the subscription company.

Or…

You can let Rocket Money do all the work and cancel the subscriptions for you, but this, unfortunately, costs extra.

To get this feature, you will need to sign up for Rocket Money premium which we will go over soon, so stick around!

Monitor For Outages

A really unique and awesome feature that Rocket Money offers is that they will monitor for internet outages in your area and work to get you some refunds if they can.

If there is an internet outage, Rocket Money will work on filing a claim to get you a refund!

Now, Rocket Money isn’t always able to get you a refund, but if they do, you will have to pay Rocket Money 40% of the refund.

This is a very unique way that most people wouldn’t think of to get a refund. I recommend checking out Rocket Money here and using this excellent feature.

Electricity Saver

A neat but pretty exclusive feature is that Rocket Money will work to save you money on your electricity bill by finding a provider that has the lowest price per kilowatt of electricity!

This is so awesome!

But…

I said it is pretty exclusive because it is only available in certain areas at this time.

To make this work, Rocket Money partnered with Arcadia which is an energy provider. To use this feature, you will have to sign up and provide some information to Arcadia, just so you are aware.

Check out Rocket Money to see if this feature is available in your area and if it is, definitely use it!

Set Budgets

The fantastic thing about Rocket Money is that it is not only an app that saves you money here and there, but it also allows you to set budgets easily so you can save money for the long term!

Rocket Money offers a free budget tool in their app that automatically analyzes the cash inflow and outflow from your linked accounts to give you an overview of your spending habits.

You can then set budgets in Rocket Money to manage your finances more carefully. Rocket Money will also give you recommended spending amounts based on your income!

Unfortunately, the free version of Rocket Money only allows you to create two budget categories; you will have to use the “everything else” category for all other spendings.

If you want unlimited budget categories, then you will have to upgrade to Rocket Money’s premium plan, which might or might not be worth it for you.

Savings Goal

A great feature that Rocket Money offers is to set savings goals!

Within the Rocket Money app, you can automatically set aside a set amount of money for a specific goal that you have in mind.

This goal can be pretty much anything, such as saving for a house, creating an emergency fund, saving money for a car, college, etc…

Rocket Money will help you move money around your accounts so you can set your savings goal and let you know when you will reach your goal by.

This is a very useful feature in the Rocket Money app that I recommend you use!

Unfortunately, this fantastic feature is only available in the premium version of Rocket Money.

Understanding Your Finances

While this is not exactly a feature in Rocket Money, what I find so great about Rocket Money compared to some of its competitors is that they allow you to understand and control your finances as a whole!

On Rocket Money, along with all the fantastic money-saving features, you will also get to set budgets and savings goals to improve your financial life significantly.

Yes, some features are only available in the premium version, but with all the features Rocket Money offers it might be worth getting the premium version.

For now, I recommend starting with the free version and then upgrading if you want.

Sign up for your free Rocket Money account here and start saving money today!

Rocket Money Cost

Rocket Money is free to download and use, but certain features are only available in the premium version, which comes at a cost.

However, the cost of the premium version of Rocket Money is pretty confusing…

Rocket Money premium costs between $4 – $12 a month, and you choose what to pay (yes, very strange).

I recommend sticking with the free plan for a while and then trying out the premium version if you would like.

You might be thinking that the premium version is expensive but let’s say that Rocket Money saves you $100 on a bill, and you had to pay a $40 fee to Rocket Money; this leaves you with $60.

Since the premium plan will cost $48 if you opt to pay $4 a month, you can use the money you saved to pay for the premium plan and then still have some money left over.

As you can see, there are some situations where Rocket Money can pay for itself!

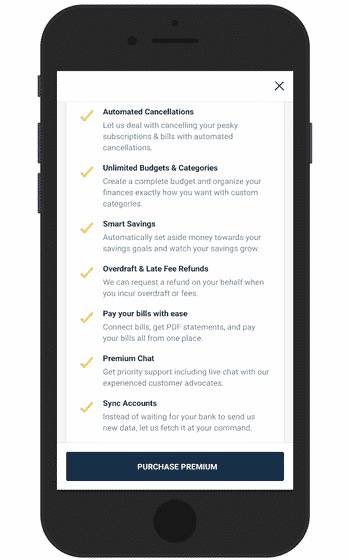

Rocket Money Premium Features

We went over the cost of Rocket Money’s premium version, and we briefly went over the features offered.

Let’s dig a little deeper into these features to see if they work for you.

The first feature is that with the premium version of Rocket Money you will not have to cancel subscriptions on your own; you can cancel subscriptions directly within the app!

With the premium version, Rocket Money will also automatically request refunds for late fees and overdraft charges to your account.

The premium version of Rocket Money also allows you to turn Rocket Money into an ultimate budgeting app with unlimited budget categories, types, and also savings goals.

Rocket Money’s premium version also allows you to pay your bills directly from the app, so you don’t have to jump from website to website for your bills.

Paying for the premium version of Rocket Money turns the app from a simple money-saving app to a powerful financial management app that will help you better manage your money.

With the amount of money Rocket Money can save you, the cost is not too bad but it all depends on your spending habits and financial management skills.

I definitely recommend just sticking with the free version for a while and then upgrading to the premium version if you feel like it can be beneficial for you.

Services Rocket Money Works With

Here are a few services that Rocket Money works with:

- AT&T

- Comcast

- Verizon (Wireless & FIOS)

- Spectrum

- Sprint

- Direct TV

- Sirius XM

- Cox

- Optimum

- ADT

As I stated before, Rocket Money mostly works with telecommunication companies for bill negotiations.

Rocket Money is constantly expanding and working with different companies so they might expand into different sectors soon and this Rocket Money review will be updated if they do.

Pros & Cons Of Rocket Money

Rocket Money is honestly an awesome app that I recommend to everyone looking to save more money and manage their finances as a whole.

But…

I would be lying if I said it was a perfect app, there are a few downsides to Rocket Money so let’s get into the pros and cons of Rocket Money in this Rocket Money review.

Pros

- Free to download and use

- A good amount of features available in the free version

- Mobile and desktop version

- Has money-saving tools as well as money-management tools

- Simple and easy-to-use user interface

Cons

- Pretty high fees at 40%

- Some features only available in the premium version

- Only available in the U.S at this time

Yes, Rocket Money has some cons and it might not be the app for everyone but as you can see the pros definitely outweigh the cons!

Rocket Money is an awesome app that can help you save money as well as manage your money!

Rocket Money FAQ’s

In this Rocket Money review we went over a lot of details about the app but here are some frequently asked questions about Rocket Money:

Yes, Rocket Money is safe to use. Rocket Money uses Plaid which is a financial encryption service to keep your data and information safe and secure.

Sign up to Rocket Money here and then you’ll need to link your bank accounts and credit cards. Rocket Money will then analyze your spending and work to save you money.

If you would like to cancel your Rocket Money account just open up the app, click on the gear icon in the top left of the app, click on your profile and you will see the option to delete your account.

Rocket Money is an app that can help you save money as well as manage your money. It is labeled as an automated financial assistant that consists of a budget planner, bill tracker, and reminder.

Rocket Money negotiates bills by contacting your service provider and finding ways to lower your bill. This can be promotional deals, a one-time credit, or simply lowering the bill entirely.

Rocket Money is free to download and use but there are some features that require you to upgrade to the premium version of the app. The premium version of the app costs between $4 – $12 a month. You choose what to pay.

Since Rocket Money is an automated financial assistant all you have to do is link your bank accounts and credit cards to Rocket Money and it will work to save you money. Rocket Money also doubles as a financial management app where you can set budgets and savings goals.

Rocket Money makes money in a few ways. The first way Rocket Money makes money is by charging fees to its users when bills are reduced by negotiations. The second way that Rocket Money makes money is by charging customers for the premium version of the app. Rocket Money also makes money when users sign up for sponsored services in the app.

Conclusion

Now that you have come to an end to this Rocket Money review, what do you think about this awesome app?

Listen… I know there are many financial apps out there that make big promises like “I will save you $1,000’s” or “You can make $1,000’s” which are obviously full of it.

So, it makes sense if you are still on the edge about signing up to Rocket Money but this app is definitely legit and just plain awesome!

If there is one thing you can learn from this Rocket Money review it is that it is super easy to save money when you have a service like Rocket Money by your side!

Since Rocket Money is completely free to start using, I recommend that everyone looking to save some money sign up for this awesome app and try it out. You can always delete your account if you find that Rocket Money is not for you.

If you are looking for some other ways to save money I recommend checking out these super frugal living tips and these surprising things to stop buying to save money.

Have you tried using Rocket Money to save money? Have anything to add to this Rocket Money review? Any further questions about Rocket Money? Let me know in the comments below!

![21 Awesome Apps For Free Food! [With Bonuses]](https://ml1npn8kqat9.i.optimole.com/cb:ydhy~32bfb/w:600/h:450/q:mauto/f:best/https://www.savebly.com/wp-content/uploads/2019/12/Apps-For-Free-Food-Cover-New.jpg)