Paribus vs Earny – The Winner Is…

Paribus vs Earny… Which one should you use?

I mean both are very similar services that can help save you money but I rather use one over the other and I’ll tell you which one and why soon.

But first…

Let’s go over both Paribus and Earny to see the features they offer and then we will compare the two.

I will then give you my recommended service out of the two so you can start saving money right now!

Let’s get straight into it…

Paribus vs Earny: What Are They?

Before we get into this post on Paribus vs Earny we need to know what these apps are and how they can save you money.

You might already know what these apps are but just stick with me to the end because I’ll tell you which one you should choose!

If you don’t know what these apps are then let’s quickly go over what Paribus and Earny are all about, but first, let me ask you a question…

Have you ever bought something only to see it for a lower price a few days later?

This sucks right?! Well, this is where Paribus and Earny come into play…

Borth Paribus and Earny are considered price correction services and they can give you refunds for the difference in the items’ price.

For example, let’s say you are signed up for either Paribus or Earny and you recently bought a shirt for $15.00. A few days later you see the same shirt for $10.00, Paribus and Earny will work to get you a refund for $5!

What makes Paribus and Earny so awesome is that they handle all of the hassle of price corrections on your behalf giving you a refund that you probably wouldn’t have gotten without Paribus or Earny.

Some of you are probably thinking, “well, why the heck do I need Paribus or Earny when I can work with stores directly for price corrections?!”

Well… The answer is that each store and credit card company has different price protection policies and it can be a real headache to deal with this yourself.

Plus, Earny and Paribus have some other awesome features that I recommend you use.

Let’s dig deeper into this Paribus vs Earny post and go over both services starting with Paribus…

Paribus

To start on a good note, Paribus is now completely free to use!

Paribus used to charge a small fee for getting you refunds but now you get to keep 100% of your refunds without any hidden costs.

I know this sounds too good to be true so let’s go over some other facts about Paribus.

Paribus is owned by Capital One which is a highly trusted financial institution, they refunded over $29 million to their users, and they work with over 25 brands to get you refunds!

However, Paribus is only available on the App Store at this time. They don’t have an app for Android devices as yet.

Let’s dig a little deeper into Paribus…

What Is It & How Does It Work

Paribus is essentially a personal assistant that works for you to find refunds that are available to you by utilizing price protection policies.

Best of all, Paribus does this all for free so make sure you sign up for your free account now!

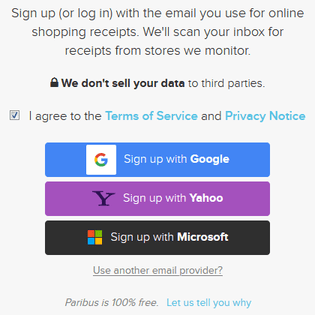

The way Paribus can do this automatically is that it accesses your email account to scan your account for receipts and order confirmations.

Yes, you’ll need to give Paribus access to your email account so it can read and send emails on your behalf.

Paribus does state that they use algorithms to only open and read receipt emails and they use high-level encryption to keep your data private and secure.

They also state that they do not sell your data. I definitely understand the privacy concerns but Paribus is a safe and legit service that can save you a lot of money!

If Paribus can get you a refund then you will get refunded directly from the retailer you purchased from. Paribus does not pay you.

Let’s jump into how to set up Paribus…

Paribus Setup

The first thing you need to do is sign up for Paribus here. You can sign up online or download the iOS app and sign up there. (remember, there is no Android app at this time)

Important tip: Remember to sign up with the email address that you use the most and that you use to receive receipts/order confirmations.

Then you’ll need to set up a username and password for your account and then provide Paribus the necessary permissions so it can work to get you your refunds!

Go through the rest of the setup process which is straightforward and then you are all set.

You don’t have to do anything else to save money. Paribus will do all the work for you. You can log in to Paribus to see the dashboard that shows you how many purchases were tracked, how many purchases you made, how much money you saved, etc…

If you choose to do so you can always delete your Paribus account by going to Settings and clicking on Profile and then deleting the Paribus account.

Now let’s go over the ways Paribus can help save you money…

How Does Paribus Save You Money

By now you already know that the main way Paribus saves you money is by getting you refunds by utilizing price protection policies but there are other ways Paribus can save you money and all are free to use!

Here are the ways Paribus can save you money:

Refunds

As we went over already, the main way Paribus saves you money is by getting you refunds for price drops on products you purchased.

Late Delivery

Another awesome way Paribus can save you money (well, give you money I guess) is by getting retailers to compensate you for items you received later than you were supposed to.

For example, let’s say you bought an item on Amazon for $100 and it said guaranteed delivery in 7 days but it arrived in 10 days then Paribus will work to get Amazon to compensate you for the late delivery.

Price Comparisons

Paribus also offers a partner browser extension for Firefox and Chrome called Wikibuy. Wikibuy is another service offered by Capital One and it’s awesome.

It compares prices for products to show you where you can get the item for the lowest price and also the price history of the product to ensure you are purchasing it at the optimal time.

While you can use the website for this, the browser extension notifies you in real-time of potential savings when shopping online.

Bonus: Return Tracking

While this is not a money-saving method, Paribus also keeps track of your online orders and shows you how many days you have left to return the specific item. This is a useful tool!

Pros and Cons Of Paribus

Paribus is an awesome service that I highly recommend using since it is free to use but there are some limitations. So, let’s go over the pros and cons of Paribus:

Pros

- Absolutely free to use

- Saves you time and money

- Does all the work for you

- Set it and forget it service

Cons

- Privacy concerns

- Only available in the USA at this time

- Can only be used for certain retailers and online shopping only

While Paribus does have some cons, the pros definitely outweigh them and that’s why I recommend signing up for a free Paribus account now!

Check out the Paribus FAQs here to learn more about their service.

Now, let’s go over Earny so we can get into Paribus vs Earny to choose the better service.

Earny

The competitor to Paribus is Earny, which is another price correction service that can save you money easily.

Earny states that they have over 3 million users and each user receives an average of $75 in refunds!

They also have an app for iOS and Android devices. The app has 3.2 stars on the Play Store and 4.6 Stars on the App Store with 1,000’s of reviews on each.

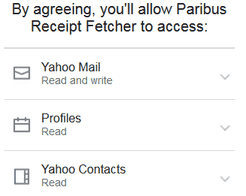

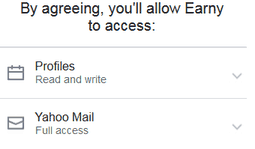

Like, Paribus, Earny will need permissions to access your email account so it can track your purchases and detect if there are any price corrections available to offer you a refund.

Let’s dig a little deeper…

What Is It & How Does It Work

Earny is a price correction service that can get you refunds for the price difference of items you purchased recently.

Their service only covers around 20 retailers at this time but they are constantly expanding so you can expect more retailers soon.

And get this…

Earny also works with credit card providers like Visa, Mastercard, and American Express to give your refunds for price corrections! (This is a win for Earny in this Paribus vs Earny guide)

There are other ways that Earny can save you money, we’ll go over this soon so keep reading.

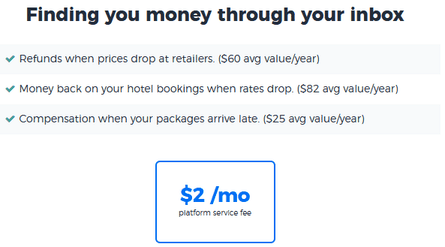

The kicker is that Earny is a paid service that costs $2 a month for all its features. There is a free version of the app available but you won’t have access to 99% of the features on the free version.

But hold up… this doesn’t mean that you should go straight to Paribus. Earny might still be worth it so let’s keep this rolling…

Earny setup

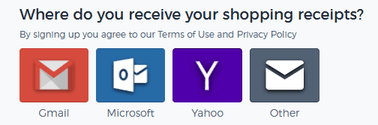

To set up Earny you just have to sign up with your email address, you can use Gmail, Yahoo, Microsoft, or another provider.

Then you will have to give Earny access to your emails (this is safe as Earny uses strong encryption to protect your data).

You will then see the screen to pay for the Earny subscription but you can also skip this and set this up later.

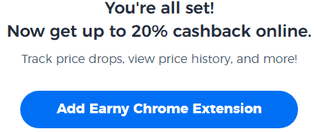

The cool thing about Earny is that it now doubles as a cashback app similar to Rakuten where you can get cash back for shopping at partner stores.

You will see this screen to install the Earny extension so you can get cash back when shopping online through Chrome.

After this, you will be brought to your account dashboard where you will see the different options to save money.

Let’s get straight into them…

How Earny Saves You Money

Earny is an awesome service because they offer many ways to save money. While you do have to pay $2 a month for these services it might be worth it.

Here are ways Earny can save you money:

Price Protection

As you already know from reading the post thus far, the main way Earny saves you money is by offering price protection refunds from their partnered retailers. Just give Earny access to your email and let it do all the work for you!

Credit Card Protection

Along with getting refunds from retailers, Earny also partners with credit card providers to work with their price protection policies to give you refunds for price drops.

Deals

Earny offers a platform where they list amazing deals from many different retailers. These deals are big drops in prices where you can get awesome items at really great prices.

For example, this woman’s coat was $128 but now it is only $49.99. If you need a new coat then this is a great deal.

You do not have to be a member of Earny to see these deals, it’s just a great feature that Earny offers for free. (sort of like Wikibuy)

Hotel Savings

An awesome service that Earny offers is that it can help you save money on hotel reservations. One way they do this is by offering the ability to book hotels right through their site/app and they partnered with Priceline to get you the best deals on hotel bookings.

The other way they help you save money is by scanning your inbox for upcoming hotel reservations and then Earny tries to find a better deal for you and if it does it will email you with all the details you need to book the hotel at the better rate.

Cashback

Earny now doubles as a cashback service that will give you cash back for shopping at over 5,000 brands through their platform.

They offer a Chrome extension that makes it easy to activate the cashback. Just shop like you normally would and the Earny extension will notify you if cashback is available.

Just activate it and you’re good to go. The extension also offers price tracking so you can know when it is a good time to purchase the item.

Earny also allows you to get cashback from within their app, you can search for stores and click the shop now button to shop and get cash back.

Earning From Friends

Another cool feature that Earny offers is a referral program that allows you to make some extra cash for inviting friends to Earny.

When you sign up for Earny you’ll get a unique referral link that you can share with people and when they sign up for Earny via your link you’ll earn $15.

But there is a condition…

Your friend must sign up for a paid Earny subscription and they need to complete their first-month payment to Earny for you to get the referral bonus.

Pros and Cons Of Earny

While Earny is an awesome service that can help you save money easily and also make some money with a few features there are a few downsides so let’s get into it…

Pros

- Save money automatically via price protection policies

- Cashback service with 1,000’s of retailers

- Credit card price protection

- Save money on hotel bookings

- Earny deals platform

- Referral program

Cons

- Must pay for a subscription to utilize all features

- Security concerns

- Some users complain about issues with the service

- Earny shares your contact information with partnered companies

The great thing about Earny is that they have a lot of features to help you save money but the privacy concerns and cost might be a turn-off for some.

Learn more about Earny by checking out their FAQ’s here.

Now let’s continue this Paribus vs Earny guide to see which service is the best to use…

Paribus vs Earny: Who Wins?

It’s the time you’ve been waiting for. Which is better Paribus or Earny?

Well… to answer this question let’s compare the two services and see where they are similar and where they differ.

Similarities & Differences

Both Paribus and Earny are price correction services that will automatically refund you the difference for the price drop in products you recently purchased.

They both also have a platform where you can find the best deals on products! For Earny this is called the deals section and while Paribus doesn’t technically have its own deals platform it is connected with its sister service WikiBuy.

Both services need access to your email account so they can scan for receipts and order confirmations to get you refunds.

However, Earny takes it a step further and will also need access to your credit card accounts to work with credit card companies to get you refunds but you can always opt out of this feature.

Both offer a price correction but where do Paribus and Earny differ?

Well, Paribus offers three features which are the price correction service, access to WikiBuy, and refunds for late deliveries.

Earny offers five features which are the price correction service, their deals platform, credit card price protection, hotel booking savings, and cashback on purchases.

Cost

One of the deciding factors on choosing between Paribus vs Earny is the cost of each service.

The great thing about Paribus is that it is completely free to use! It’s free to sign up to and they don’t take any commission for getting you refunds!

On the other hand, while Earny does have a free version of their service it only gives you access to their deals and cashback platforms.

To unlock all of Earny’s features you’ll have to pay for an Earny subscription which costs $2 a month.

It’s definitely not much for all the features Earny offers but if you’re just looking for a price correction service then Paribus might be the better option.

Security Concerns

One of the biggest downsides of both Paribus and Earny is the security concerns with using these services.

The reason is due to the email permissions both services need to get you refunds.

If you use Earny and choose to opt for the credit card price protection you’ll need to grant Earny access to your credit card account which is another security concern.

Both services use high-level encryption to keep your data safe but Earny is known to make money from selling your contact information to legit businesses.

This just means that you will probably get more promotional emails from companies than you usually get, it can be annoying but it’s not a security breach or anything like that.

Paribus states that they do not sell any of your data, period.

Verdict

We went over a lot of information in this Paribus vs Earny guide, so let’s decide on a winner.

And between Paribus and Earny, the service I recommend you use is…

This is because the reason you would use any of these services is for their main feature which is the price correction service.

Yes, Earny does come with more features but it does come at a cost.

So, here is a tip for you…

Use Paribus which is completely free and doesn’t sell all your information and also use a cashback app like Rakuten or Dosh to get all the cashback features Earny offers.

This way you will have more features for absolutely free!

I know… I know… with Paribus you will have to use two or more different services to get all the features Earny offers but it’s free to do so and you’ll get more features than Earny by using a cashback app like Rakuten or Dosh.

I have nothing against Earny but I just don’t feel like it’s necessary to pay for the features they offer, you can get them for free by using other services.

So, get Paribus right here and set it up so it can work on autopilot, and then pair it up with a cashback app like Rakuten or Dosh to further boost your savings.

Conclusion

In this Paribus vs Earny guide we went over all the features both services have to offer and while Earny offers more features than Paribus it costs $2 a month and they sell your contact information to companies.

Knowing this, I recommend you use Paribus which is 100% free to use and completely safe as well. Just partner Paribus with a cashback app like Rakuten or Dosh and you’ll have all the features Earny offers (maybe more) for free!

Now… Earny is not a scam at all. Yes, they sell some of your contact info to companies but these are legit companies that will send you promotional emails from time to time, with no scams at all!

You can definitely try Earny out to see if it works for you, I mean $2 a month isn’t going to kill you but at the end of the day if you were to choose between Earny and Paribus, I would say go with Paribus hands down.

If you are looking for some other awesome services that can help you save money automatically check out this app that can help you save $100’s on bills and this app that will help you save $100’s on groceries!

Have you used Paribus or Earny before? Now that you read this Paribus vs Earny guide, which service do you think wins? Have anything to add? Let me know in the comments below!