Money Moves To Make In Your 20s (Must Read)

Looking for the best money moves to make in your 20s?

I’m in my 20s and I am all in on this financial freedom journey but there are certain money moves that I feel need to be talked about more.

Okay so let’s just get something straight, I enjoy reading personal finance books and blogs but most of them have a similar trend which is saving as much money as you can and living really frugal.

Before you exit this post thinking I don’t want you to save money, hear me out.

I am all for saving money and being frugal but if you are in your 20s then you should be really focused on making more money!

Save as much money as you can, build up your emergency fund but spend most of your time and efforts on making more money!

Let’s dig a little deeper into the best money moves to make in your 20s…

Make Money

As I said if you are in your 20’s you should be really focused on making more money. It’s one of the best money moves to make in your 20s!

But how?

Well, there are many ways to make more money and I am not talking about doing surveys here and there with services like Swagbucks or Amazon Mechanical Turk.

I’m talking about getting a new job/career or getting a raise/promotion!

Think about going to college or a trade school to enter a new career path to make more money.

I know everyone’s situation is different but according to the United States Census Bureau, in 2015, 24 million young people aged 18 – 34 still lived at home with their parents and the number increased since then!

So, if you are currently living with your parents then you probably don’t have many expenses and if this is the case you should be focused on making more money instead of focusing all your efforts on saving money.

For example, I am making sure that I save as much money as I can but I am so focused on making more money so I can provide for my family in the future.

Along with writing on this blog, I have a career in IT and I am working to expand my knowledge and get further in my career.

Now I am not telling you what to do but by focusing on making more money you will be able to keep up with inflation and rising prices.

If you like your job considering starting a side hustle like woodworking, selling candles, locksmithing, etc…

This is the time in your life to set the foundation for your financial future, so build a strong foundation and you will look back and be proud that you did!

Invest Your Money

Great, now that you are making more money what should you do with it?

No, I am not telling you to make more money just to spend more money. I want you to make more money to invest it so you can make even more money!

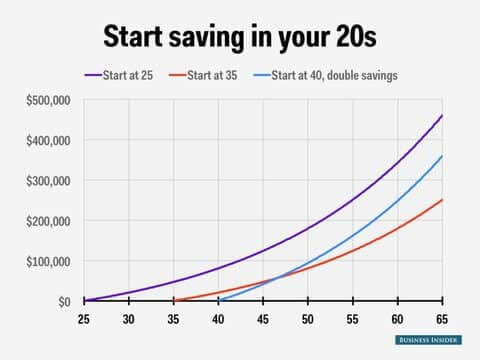

You should definitely start investing at an early age to use the power of compound interest.

This graph shows the power of compound interest and how starting at an early age really adds up later on!

Where Should You Start?

Well, if you have a job then start with your employer’s 401k or 403b plan. They might even match your contributions up to a certain percentage and this is basically free money!

Or if for some reason you aren’t able to contribute to a 401k/403b then consider opening up an IRA.

I can talk all day about investing and the best practices but this will take way too long, instead, I recommend getting the book The Little Book of Common Sense Investing by Jack Bogle.

This book will give you all the information you need about basic investing, I owe a lot of my investing knowledge to this book!

Simply, make more money by grinding at work then invest as much money as you can!

This is how you will get rich. Investing is one of the best money moves to make in your 20s!

Do Something

What do I mean by doing something?

Well I mean to do something other than your job. Start that business you are thinking about, start that blog you wanted to start, start that YouTube channel… you get the point.

We all have something else we want to do if you love your job that’s great but most people have another calling and that is perfectly fine.

Just start! You won’t know unless you do.

If you are interested in starting a blog or website then check out my in-depth guide here on how to do so!

Is it possible that you will fail? Yes. Is it possible that you will lose some money? Yes.

Listen, there is no certainty when it comes to making money. There is no formula I can give you to become a millionaire but I do know that taking certain steps in your life can greatly improve your chances.

You can work and invest as much as you can for how long you can, which will work.

But…

You can also build that business you love to make more money and then invest the business profits for maximum returns on your money!

Check out my post on the fastest ways to get rich!

Start something and do something great! You never know what can happen.

Start An Emergency Fund

No matter what age you are, you should have an emergency fund in place for those unexpected costs that will come up at some point in your life.

I know what you’re thinking, “what if I live with my parents and I barely have any expenses? Why should I have an emergency fund?”

No matter if you live with your parents or live by yourself, you shouldn’t depend on anyone else to cover those unexpected expenses that will come up.

In your 20’s you most likely haven’t started a family of your own as yet or you just started, so you should really start building up your emergency fund up now to prepare for the future.

And you probably don’t have many expenses yet so it is the perfect time to start building your emergency fund.

How much you should put in depends on a lot of factors but the rule of thumb is that you should have 3 to 6 months’ worth of expenses in your emergency fund.

But…

Everyone’s situation is different so put as much into your emergency fund to the point where you feel comfortable and safe.

I shoot for at least 6 months worth of expenses in my emergency fund because my philosophy is that you can never be too safe but you will be sorry if you didn’t plan correctly.

Starting an emergency fund is one of the most important money moves to make in your 20s!

Pay Off Debt

You should always focus on paying off your debt!

In your 20’s your most likely burdened by student loan debt and maybe some credit card debt.

Well, if you do have credit card debt, focus on paying them off first because credit cards hold higher interest rates then student loans and the balance should be less (hopefully)!

Save as much money as you can by not buying things you don’t need or really want and throw that money at your debt.

Also, as I said before, focus on making more money so you can have more money to get rid of your debt without having to find other ways to cut costs.

Simply, save more and make more so you can pay off your debt quicker.

Learn To Use Credit

If you read anything in personal finance you most likely heard to pay off all of your credit card debt, cut them up, and use cash from now on.

I do agree with this but at the same time, I do believe credit cards can be useful tools if you know how to use them!

This is key, only if you know how to use them. This means charging things that you can afford to pay off immediately before interest kicks in.

I am not saying to use credit cards all the time but there are some benefits of using them, so let’s quickly go over the benefits.

Rewards

As you may know, already most credit cards offer some type of reward for using them for purchases.

This can be airline points, hotel points, cashback, etc…

So you can buy what you need with the credit card, pay it off immediately so you don’t pay any interest, and get some rewards!

It’s that simple, but you must be able to pay off the balance before interest accrues!

Sign Up Bonuses

Some credit card companies will actually pay you to open a credit card with them!

But, it’s not that simple. These cards have certain rules like spending a certain amount in a certain time to get the bonus or keeping the card open for a certain amount of time.

So, you just have to follow those rules and you get cash right into your pocket!

You can cancel the credit card after all the rules are followed and you get your bonus but just know that closing cards a lot may have a negative impact on your credit score. You can just keep the card open and not use it but be cautious of any annual fees.

It is a simple way to get some money but like I said you have to really know what you are doing and use the credit cards properly so you don’t pay any interest!

Security

Credit cards are seen as a safer way to shop than using a debit card or cash.

Now, what protection you have will depend on your credit card issuer but you will most likely have more consumer protection.

For example, when you purchase certain items you will get a manufacturer warranty for a set of time but when that expires your out of luck, right? Well, certain credit cards offer an extended warranty for items at no additional cost to you!

Also, if you are buying something from a not so well-known website or store then using a credit card will be safer because credit cards are better equipped for consumer protection.

Travel Security

This ties in with the last point but I felt it needed its own section because I feel as if you should definitely use a credit card when traveling to a foreign country!

We spoke about the protection credit cards give you and this still holds true when traveling internationally.

You should not be traveling to another country with a bunch of cash and using a debit card isn’t that safe either.

I am not telling you to rely solely on your credit card, it is good to use cash at times but you should learn when to use cash and when to use your credit card.

Check out this article by Bankrate on some tips for using your credit card overseas.

Credit Score

This is the most important reason to use a credit card!

When you use a credit card, your credit card company reports your payment behavior to credit bureaus which determines your credit score (FICO score).

Okay, but what the heck does that mean?

So your credit score essentially shows how good you are with paying back money that is loaned to you. If you consistently pay your credit card bills on time then you will start building a good credit score.

But why do you need a good credit score?

Well if you plan on taking out any type of loan then you will need to have a good credit score.

Is it possible to take out loans with a bad credit score?

Yes, some places will allow you to but just know that you will be paying a much higher interest rate on your loan!

A good credit score will allow you to take out loans easily and you will be eligible for lower interest rates on your loan.

So a good credit is important when buying a house, buying a car, taking out a private student loan, etc…

Also, having a good credit score is important for renting also since it shows your ability to pay bills in full and on time.

So, as you can see credit cards do have their benefits. While I still believe cash is king, there are times you should be using a credit card.

You should use a credit card here and there to build a good credit history so when it’s time to take a loan out, you won’t have to pay an arm and a leg!

Utilizing credit is one of the best money moves to make in your 20s!

Conclusion

These are the best and most important money moves to make in your 20s!

Yes, go ahead and have fun, nobody wants to stop you but you should also be focusing on setting up your financial foundation so you are not burdened with money problems later on in life.

Small changes in your 20’s can have big changes, later on, think of it as a snowball effect.

These are just 5 money moves to focus on in your 20’s so you can build a solid financial future for yourself. I’m not telling you to be a financial expert here, just really focus on spending your money wisely.

Along with spending wisely, spend most of your efforts on making more money!

Simply, make more money and spend less money. Then use that money to pay off debts and invest.

This is personal finance in a nutshell!

Learn to make every dollar count and learn to make your money work for you!

Be sure to check out my post on How To Build A Successful Life and Tired Of Being Poor? Here’s What To Do.

What money moves are you making or made in your 20’s? Also, do you have anything else to add? Drop a comment below!

Great advice! I am not in my 20s any more but I wish I had read this when I was!

Thanks Kristen! Simple changes early on can have a big impact on your life later on. Thanks for reading!

I love this post! Amazing advice! Keep it up 🙂

Thank you Radhika! 🙂