6 Shocking Millennial Spending Statistics

Millennials often get a bad reputation when it comes to finances (trust me I know, I’m a Millennial).

You probably are a Millennial too, as Millennials (or Generation Y) are born between 1981 and 1997. So if you are born between these years, welcome aboard!

Also, you probably know about the sh*t we get about our spending habits. For example, I’m sure you have heard about the viral article that states Millennials are spending too much money on avocado toast and coffee.

I mean yes, of course, spending a lot of money on food and entertainment can put a dent in your finances but is it the real reason Millennials are struggling to afford things?

No… just no. The reason is rising costs in areas such as housing, health care, transportation, education, etc…

So, yes you should watch the small costs like that $6 coffee you buy every day (you know who you are) but if you are not focused on these big costs then you are pretty much running in place.

According to a study done by Student Loan Hero, Millennials will pay 39% more for their first house compared to Baby Boomers and according to MarketWatch, college tuition rose 161% from 1987 to 2016!

The study by Student Loan Hero also states that Millennials received a 67% increase in wages since 1970 but it is just not enough to keep up with the increasing living costs.

With rising tuitions, Millennials are graduating college with a hefty debt over their head. This puts a halt to plans of purchasing a house.

So, do Millennials have some bad spending habits (like spending too much on coffee)? Yes, of course! But so does other generations like the Baby Boomers who are not great at keeping an emergency fund.

I believe that even though Millennials have some bad money habits, the major financial burdens listed above are pretty much out of our control thus leading to different lifestyles than previous generations.

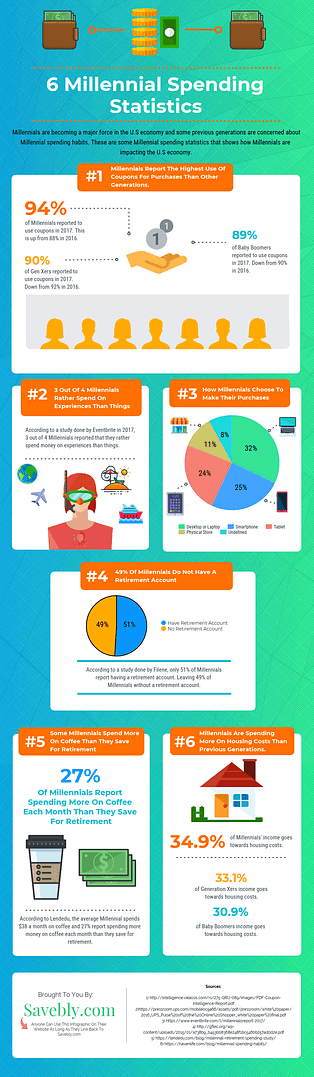

Millennials are beginning to adapt to their financial situations. As you will see in the infographic below, Millennials are using more coupons than previous generations and they rather spend money on experiences over stuff.

Let’s get into the infographic on Millennial money statistics!

6 Millennial Spending Statistics

If you have a blog or website feel free to use this infographic just link back to this article somewhere in your post. (Download the Millennial Spending Statistics Infographic Here)

Regardless of the generations, we are all human and we make mistakes, but that is the reason why financial sites like Savebly are around. Financial literacy is a learned skill so keep on learning!

If you are a Millennial what is your biggest financial burden? What are your spending habits?

I totally agree with the cost of everything is going up. Even with the increase in minimum wage, the average consumer cannot keep up.

I don’t think it’s just a millennial problem because I see people of all ages overspending for the amount of income they earn. Plus I think millennials get picked on quite a bit.

Many people go to college and owe massive debt so I agree it’s a common problem for most.

Thank you for sharing.

Thanks for the comment, Andy. It definitely isn’t just a Millennial problem, the increasing cost of living along with wage stagnation is affecting individuals among all generations. Student loan debt is becoming unbearable for most people and there is a need for actions to control it.