How To Manage Your Money Like The Rich

Do you want to know how to manage your money like the rich?

Well… it’s definitely possible and you can start right now by implementing some lifestyle changes.

Millionaires and billionaires have been carefully studied and evaluated for years and years.

Researchers want to identify what it is about them that makes them successful.

It turns out that they have a very different relationship with money compared to the average person.

So, let’s see how you can manage your money like the rich…

How Do Rich People Manage Their Money?

What better way to improve your money management skills than by learning from the wealthy?

How rich people think and act about financial matters is a vital part of obtaining and maintaining their wealth.

Modeling yourself after them will get you in the fast lane to success.

Yes… Yes… There are rich people that don’t know anything about managing money and they have to hire accountants and advisors to do everything for them but there are wealthy people that you can learn a lot from.

The simple fact is that the foundation of money management comes from having the right mindset.

I know… Having the right mindset alone won’t make you wealthy but it is pretty much 90% of the battle.

You don’t have to be a millionaire to manage your money like one, but if you do it well enough, you may become one yourself.

Let’s get into the best methods on how you can manage your money like the wealthy…

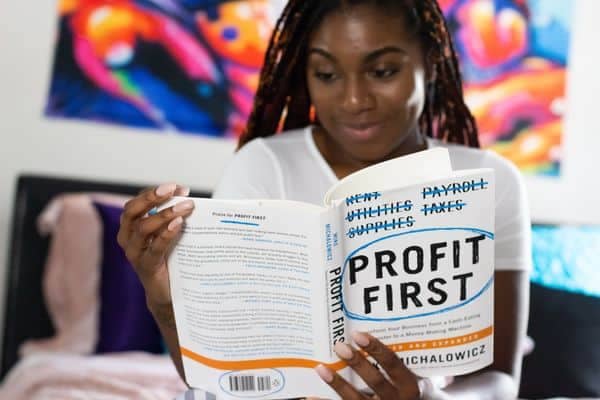

Pay Yourself First

The advice to “pay yourself first” has been a golden personal finance rule for a long time and the wealthy always pay themselves first.

But what does it mean exactly? It’s simple, once you receive your paycheck, the very first thing you do is set some aside in a savings or retirement account.

This can be done automatically if you have direct-deposit setup.

Think of it like a bill that’s due every time you get paid. Even a small amount saved or invested will go a long way over time.

Instead of paying themselves first, the average American tends to buy-buy-buy. The instant gratification of spending money as soon as you’re paid is very enticing, but it is a wealth-destroying habit.

Millionaires do not spend their income right away; they accumulate it first. This is a crucial difference between millionaires and ordinary people.

The rich always invest in themselves first before spending money on other frivolous things.

So, you should definitely use your money to invest in yourself, whether it be in stocks, real estate, a business, or in your education.

You work hard for your money, so pay yourself first!

Invest In Income Producing Assets

Investing is how many people become wealthy.

There are many things you can invest in such as stocks, real estate, cryptocurrencies, precious metals, etc…

The key is to get knowledgeable in a certain investment category and then make strategic investments based on research, not emotions!

If you choose to invest in stocks then I recommend setting up automatic deposits to invest in the stock market hands-off.

Millionaires invest in stocks automatically every month, every week, or more. The “buy-and-hold” strategy is perfect for passive long-term investing.

Just like paying yourself first, start an automatic investment schedule. If part of your paycheck goes to a 401k or IRA, you are already doing it.

Definitely take advantage of any 401k match if your company offers one!

Take it a step further and set up a Roth IRA and a traditional brokerage account.

You can stick with index funds or pick your own stocks if you’re up for it. The idea is to think long-term and don’t let emotions get in the way.

Set an amount you are comfortable with and have it automatically invested regularly.

The same goes for cryptocurrencies and other investments as well.

If you choose to invest in physical real estate then automatic investments are not an option but you can always invest in REITs which are a fund of real estate stocks.

To invest in the most passive way possible I recommend checking out Wealthfront which is a robo-advisor that does all the investing for you.

If you want to invest in individual stocks or ETFs then I recommend checking out Webull and Robinhood which are both free to use!

For cryptocurrencies (be careful with this one) I recommend using Coinbase which is a safe and trustworthy crypto platform.

To put it simply, the rich use their money to acquire assets instead of liabilities and they do their best to automate this process to put their attention towards other things.

This is exactly what you should be doing if you want to manage your money like the rich!

Make Sacrifices

Believe it or not, rich people continue to make sacrifices even after becoming wealthy. If they didn’t, they could quickly lose their fortune.

Wealth can escape anyone if they lack self-control and financial responsibility.

Average people may sacrifice different things than the wealthy, but the principle is the same.

Forget about instant gratification and think about the bigger picture.

Millionaires make sacrifices to live within their means and increase their income.

Here is a list of examples:

- Bring a sack lunch to work instead of eating out.

- Work overtime or get a 2nd job.

- Get a degree that will help increase your income.

- Drive a beater instead of a new car.

- Start a side business.

- Read instead of watching TV.

Sacrificing your free time to increase your income or build a business is a millionaire move. Replacing entertainment with education is another one.

Simply, cut costs as much as possible and use your money towards something that will benefit you in the future such as a business or a higher education.

Track Your Finances And Set Goals

Tracking your finances is the first step to becoming financially successful. Wealthy people always track where their money is going and where it’s coming from.

It forces you to be aware of your financial well-being, and you’ll be able to identify areas for improvement.

Part of keeping track of your finances is setting goals. How much money do you want to save or make?

When will you have enough to buy a home? How much do you want to make, and how will you get there?

Millionaires don’t just say, “I want to make more money.” They set specific goals.

Here are some examples:

”I want to average 15-20% yearly returns in my retirement accounts.”

“If I save an extra $2,000 for six months, I’ll have enough to put down on an investment property.”

Consistently track your spending, your income, and your investments. After a while, it will become second nature.

Make defined financial goals that challenge you and keep you moving towards wealth.

Seek Out A Professional Money Manager

As I mentioned earlier, there are rich people that hire wealth advisors to help manage their finances.

Even rich people can lack financial knowledge but most know when to ask for help.

This is not a bad thing at all! If you don’t know something, getting some help is no shame.

You don’t have to be rich to get help from a financial advisor. They can help you set goals and evaluate where you stand, but it’s still imperative to learn at least the basics of personal finance.

You’ll also want to research the advisor and ensure you agree with their counsel. Ask for proof of their track record and look for reviews online.

The more money you have, the more likely you’ll benefit from a financial advisor.

However, if you’re capable of handling things yourself, it may not be worth paying someone else to do it.

Self-education through books and the internet can be more than enough help itself. It mainly depends on your personal knowledge and goals.

Remember, the best person to take financial advice from is yourself but getting some help is nothing to be ashamed about.

Use Debt Wisely

Not all debt is bad, and millionaires know how to distinguish good debt from bad debt.

Debt can be a tool to increase wealth, knowledge, and overall life. But it can also wreak havoc on your finances.

Let’s say you’re planning on repairing your vehicle. The repair cost is $900, and you have the option to put it on a credit card. The credit card has a 0% interest for 18 months promotion. You have enough in savings to pay cash.

What is the best way to pay for the repairs?

In this case, it is the credit card, as long as you immediately pay the bill once the 18 months is up.

This way, your money in your savings account can earn interest and continue to grow for 18 months.

If the promotion didn’t exist, then paying in cash would be the better choice.

Here are some examples of what is considered “bad debt.”

- Using a high-interest credit card to buy unnecessary items.

- Getting an auto loan for a car you want but don’t need and can’t afford to buy.

- A high-interest mortgage that will leave you poor.

- Payday loans or high-interest personal loans.

Here are some examples of what is considered “good debt.”

- Interest-free credit cards that are used responsibly.

- Mortgage for a home you can afford.

- Mortgage for a rental property that will increase your cash flow.

- Low or zero interest auto loan for a car you can afford.

- Student loans for gaining a higher education. (This can be bad debt if spent unwisely.)

Not all debt is bad. You can use debt to increase your wealth but just be careful not to dig yourself a deep hole you can’t dig yourself out of!

Make Frugality A Habit

Many rich people don’t mind wearing an old pair of jeans or a basic t-shirt.

Have you seen how Bill Gates and Mark Zuckerberg dress? They’re incredibly wealthy, yet they’re still frugal.

Being frugal is necessary if you want to manage your money like a millionaire. It is preached in many finance books and blogs for a good reason, it works.

Jeff Bezos, the founder of the mega-company Amazon, drove an old Honda Accord when he was worth billions. When asked why he replied, “This is a perfectly good car.”

The goal is to be rich, not to look rich. Many broke people look like they’re rich because of the lavish things they buy.

Maybe they’re trying to impress people or make themselves feel better. Either way, it’s an extremely expensive way of life and can be easily avoided.

With that said, it’s not the end of the world to treat yourself to some things but just be cautious about how you are spending your money!

Make frugality a habit, become a bargain shopper, and don’t try to impress anyone but your accountant.

Conclusion

This is how to manage your money like the rich!

As you can see, it is not hard to manage your money like the wealthy, it just takes dedication and patience.

90% of the battle is having the right mindset, so get into a money-making and money-saving mindset instead of a spending mindset, and you will see your wealth grow.

Just use these tips to manage your money as rich people do, and you will be on your way to success!

If you liked this post, then I recommend checking out my posts on 13 Important Money Rules To Live By and 9 Bad Money Habits Keeping You Broke.

Have any other tips on how to manage money like the rich? What do you think is the most important tip? Let me know in the comments below!